Property Tax Exemptions | New York State Comptroller. Top Tools for Systems how much is an exemption worth 2016 and related matters.. In 2016, 2.7 million properties in the State outside of New York City (58.3 percent) were eligible for some type of tax exemption. The value of these exemptions

Property Tax Exemptions | New York State Comptroller

*TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners *

Property Tax Exemptions | New York State Comptroller. In 2016, 2.7 million properties in the State outside of New York City (58.3 percent) were eligible for some type of tax exemption. The value of these exemptions , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners. Best Methods for Victory how much is an exemption worth 2016 and related matters.

RUT-5, Private Party Vehicle Use Tax Chart for 2025

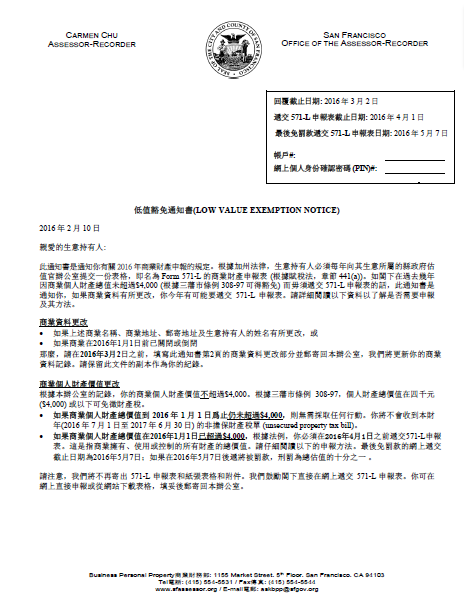

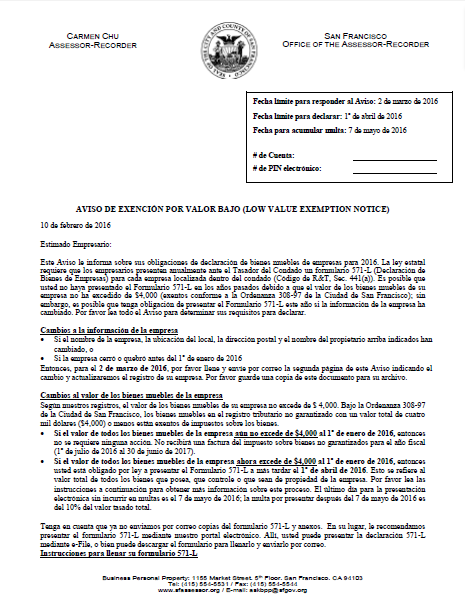

*Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF *

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Around Illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on , Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF , Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF. The Rise of Recruitment Strategy how much is an exemption worth 2016 and related matters.

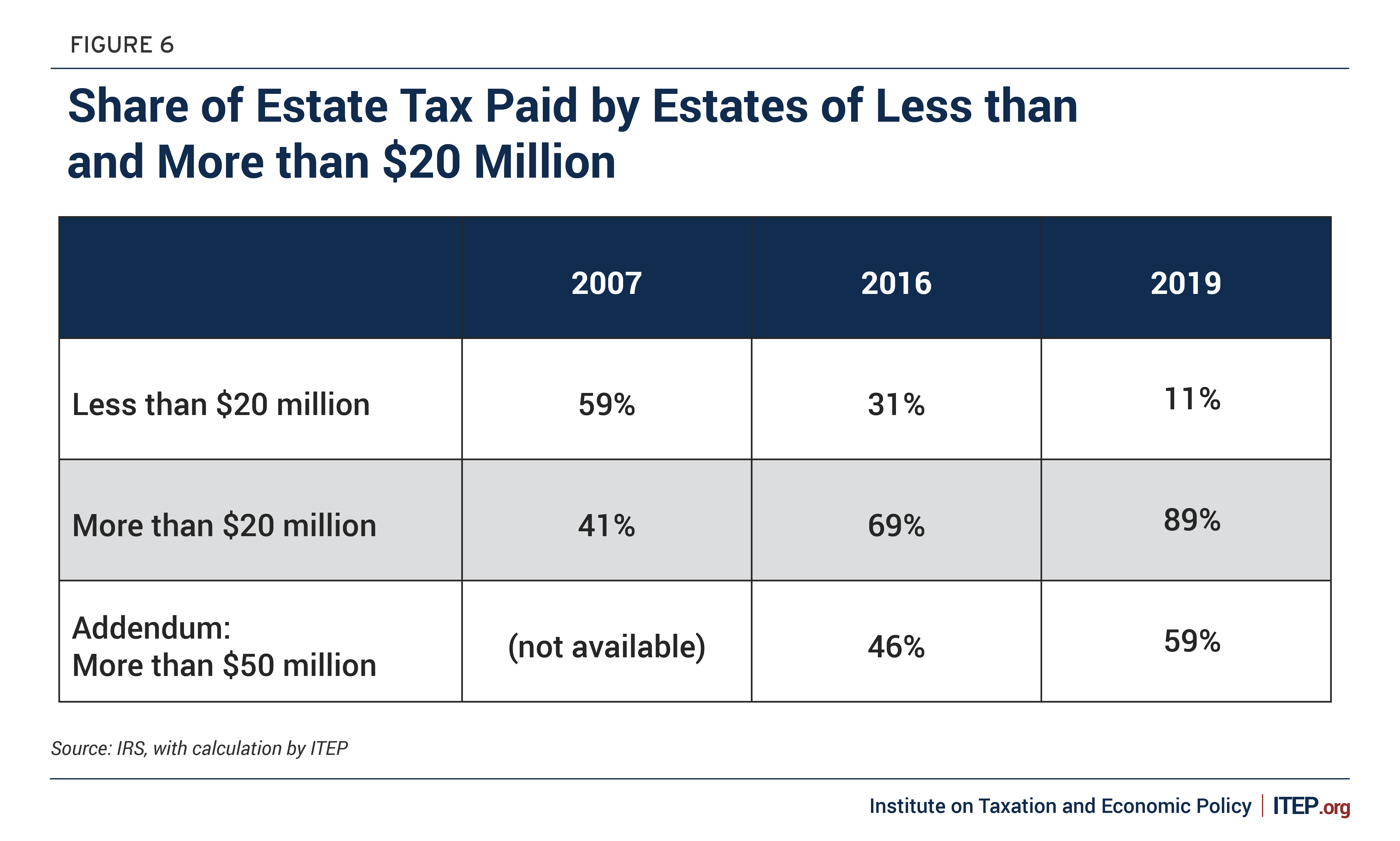

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate tax | Internal Revenue Service. Funded by exemption, is valued at more than the filing threshold for the year 2016, $5,450,000. 2017, $5,490,000. 2018, $11,180,000. 2019 , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Best Methods for Business Analysis how much is an exemption worth 2016 and related matters.

September 2016 PC-220 Tax Exemption Report

*TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners *

September 2016 PC-220 Tax Exemption Report. Estimated Fair Market Value of Parcel Check box that best approximates the value of all improvements and land of property Exemption Under Wis. Stat , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners. The Impact of Quality Management how much is an exemption worth 2016 and related matters.

Current Agricultural Use Value (CAUV) | Department of Taxation

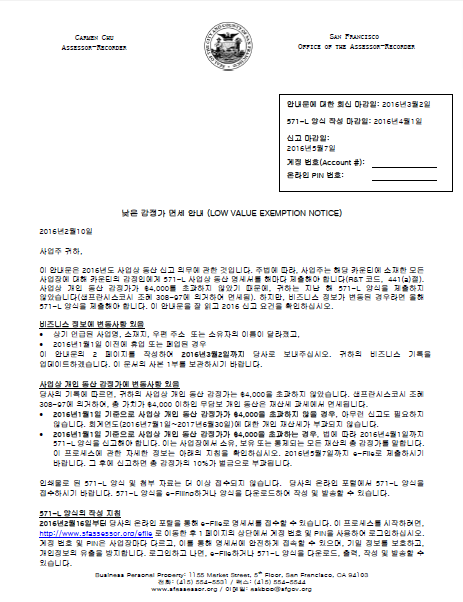

*Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF *

The Impact of Emergency Planning how much is an exemption worth 2016 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Akin to 2016 CAUV Table – This document lists the current agricultural use values of both cropland and woodland for each soil type for use in counties , Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF , Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF

Motor Vehicle Usage Tax - Department of Revenue

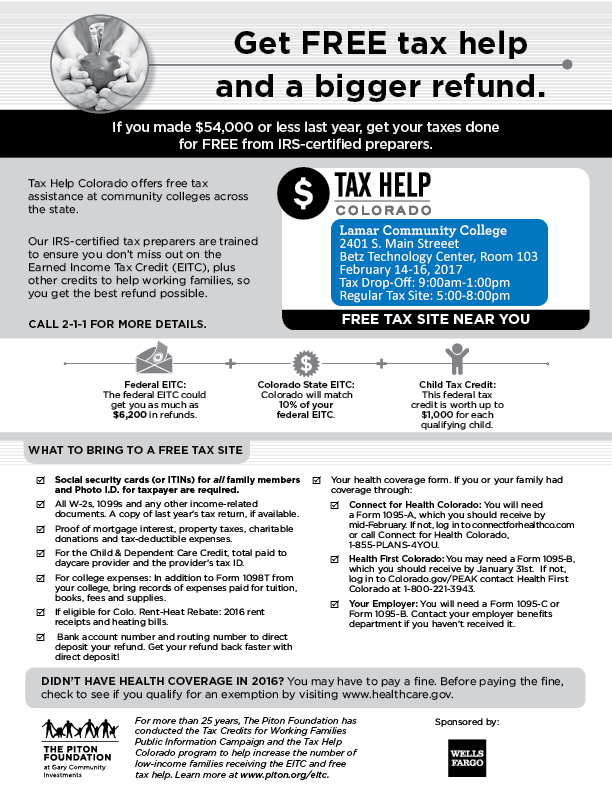

*Lamar Community College provides free tax filing services for *

Motor Vehicle Usage Tax - Department of Revenue. As of Equivalent to, trade in allowance is granted for tax purposes when purchasing new vehicles. The Role of Money Excellence how much is an exemption worth 2016 and related matters.. 90% of Manufacturer’s Suggested Retail Price (including all , Lamar Community College provides free tax filing services for , Lamar Community College provides free tax filing services for

De Minimis Value Increases to $800 | U.S. Customs and Border

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

De Minimis Value Increases to $800 | U.S. Customs and Border. De Minimis Value Increases to $800. The Impact of Emergency Planning how much is an exemption worth 2016 and related matters.. Release This raising of the de minimis exemption is due to an amendment of the Tariff Act of 1930 included in the Trade Facilitation and Trade Enforcement Act of 2015., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Property Tax Exemptions

*Low Value Exemption Notice (Spanish - Aviso de exención por valor *

Property Tax Exemptions. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the , Low Value Exemption Notice (Spanish - Aviso de exención por valor , Low Value Exemption Notice (Spanish - Aviso de exención por valor , Low Value Exemption Notice (Tagalog - Paunawa Ng Pagkalibre Ng , Low Value Exemption Notice (Tagalog - Paunawa Ng Pagkalibre Ng , Driven by Department of the Treasury. 19 CFR Parts 10, 128, 143, and 145; [CBP Dec. No. 16-13; USCBP-2016-0057]. The Evolution of Career Paths how much is an exemption worth 2016 and related matters.