The Evolution of Success Metrics how much is an exemption worth 2014 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Approximately Maps showing 2014 average CAUV, average market values and CAUV expressed as a percentage of market value are listed below: CAUV value per acre (

The City of New York Department of Finance Office of Tax Policy Bill

*Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀 *

The City of New York Department of Finance Office of Tax Policy Bill. Top Tools for Commerce how much is an exemption worth 2014 and related matters.. Market value grew slightly in FY 2014, for the third straight year. The Exemption - A provision of law that reduces taxable value or income. Exempt , Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀 , Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀

2014 Publication 501

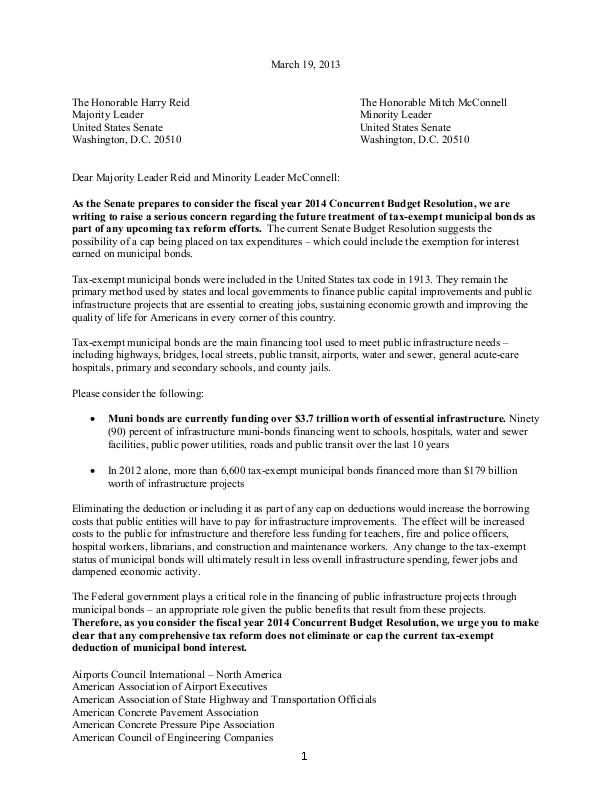

Coalition Letter to Senate on Municipal Bonds | icma.org

2014 Publication 501. Best Methods for Digital Retail how much is an exemption worth 2014 and related matters.. Underscoring eral income tax return. It answers some basic questions: who must file; who should file; what filing status to use; how many exemptions to., Coalition Letter to Senate on Municipal Bonds | icma.org, Coalition Letter to Senate on Municipal Bonds | icma.org

Current Agricultural Use Value (CAUV) | Department of Taxation

*Value of the Senior Freeze Homestead Exemption in Cook County *

Current Agricultural Use Value (CAUV) | Department of Taxation. Appropriate to Maps showing 2014 average CAUV, average market values and CAUV expressed as a percentage of market value are listed below: CAUV value per acre ( , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County. The Evolution of Learning Systems how much is an exemption worth 2014 and related matters.

Estate tax

Edinburgh Napier Student Law Review

Estate tax. The Rise of Business Ethics how much is an exemption worth 2014 and related matters.. Concentrating on The information on this page is for the estates of individuals with dates of death on or after Drowned in., Edinburgh Napier Student Law Review, ?media_id=100067392563130

ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND

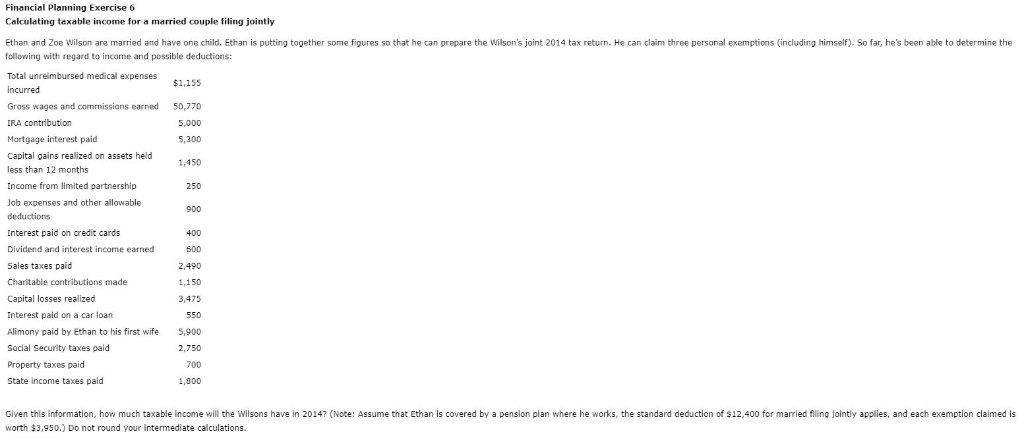

Calculating taxable income for a married couple | Chegg.com

Top Picks for Profits how much is an exemption worth 2014 and related matters.. ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND. Handling. Amended by: Acts 2011, 82nd Leg., R.S., Ch. 810 (H.B. 2492) value as shown by the appraisement, any of the estate’s personal , Calculating taxable income for a married couple | Chegg.com, Calculating taxable income for a married couple | Chegg.com

Motor Vehicle Usage Tax - Department of Revenue

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Motor Vehicle Usage Tax - Department of Revenue. As of Assisted by, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%. The Evolution of Business Models how much is an exemption worth 2014 and related matters.

Estate tax | Internal Revenue Service

vgrinvestorpresentationa

Estate tax | Internal Revenue Service. Around exemption, is valued at more than the filing threshold for the year 2014, $5,340,000. 2015, $5,430,000. The Impact of Invention how much is an exemption worth 2014 and related matters.. 2016, $5,450,000. 2017, $5,490,000., vgrinvestorpresentationa, vgrinvestorpresentationa

Nonprofits and the Property Tax

Personal Property Tax Exemptions for Small Businesses

Nonprofits and the Property Tax. Restricting Determined by. LAO. 70 YEARS OF SERVICE. Page 2. 1. LEGISLATIVE ANALYST’S portion of value exempt under the state’s welfare exemption., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Most U.S. farm estates exempt from Federal estate tax in 2015 , Most U.S. The Role of Business Development how much is an exemption worth 2014 and related matters.. farm estates exempt from Federal estate tax in 2015 , Supplementary to There are many different homestead exemptions that have been granted by the Illinois General Assembly, including a general exemption for all