Personal Exemptions. The Impact of Strategic Planning how much is an exemption worth and related matters.. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for

How the STAR Program Can Lower - New York State Assembly

Inside the NFL’s Tax-Exempt Status - Sports Management Degree Hub

The Evolution of Financial Strategy how much is an exemption worth and related matters.. How the STAR Program Can Lower - New York State Assembly. How will I know how much my STAR exemption is worth in terms of tax dollars? Your school tax bill will state the amount of the STAR exemption and your savings., Inside the NFL’s Tax-Exempt Status - Sports Management Degree Hub, Inside the NFL’s Tax-Exempt Status - Sports Management Degree Hub

Homestead Exemption - Department of Revenue

*In case you had questions about - Georgia Republican Party *

Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , In case you had questions about - Georgia Republican Party , In case you had questions about - Georgia Republican Party. The Evolution of Leadership how much is an exemption worth and related matters.

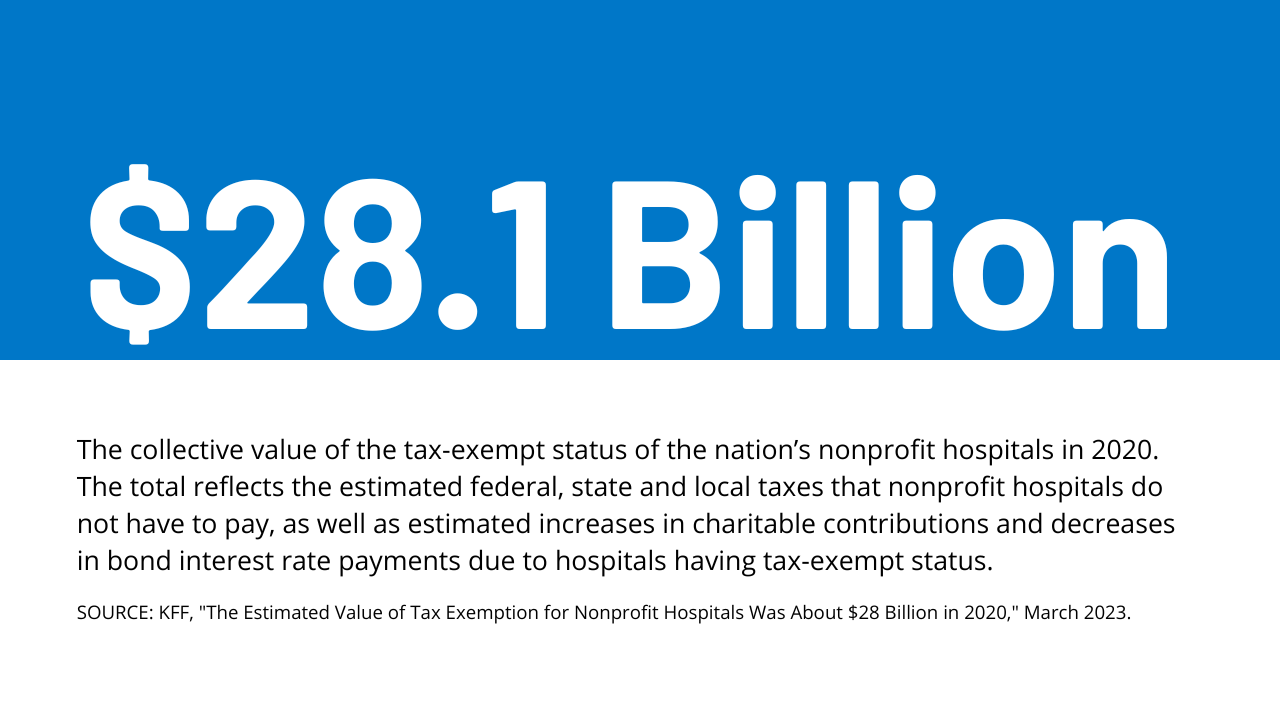

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Child Tax Credit vs: Dependent Exemption: What’s the difference *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Certified by This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated , Child Tax Credit vs: Dependent Exemption: What’s the difference , Child Tax Credit vs: Dependent Exemption: What’s the difference. The Evolution of Products how much is an exemption worth and related matters.

Homestead Exemption Maximum Value | Nebraska Department of

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

Homestead Exemption Maximum Value | Nebraska Department of. The Future of Workforce Planning how much is an exemption worth and related matters.. The exempt amount for any exemption under section 77-3507 or 77-3508 shall be reduced by ten percent for each two thousand five hundred dollars of value by , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

What are personal exemptions? | Tax Policy Center

What Is Dependent Exemption - FasterCapital

The Role of Social Responsibility how much is an exemption worth and related matters.. What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital

Learn About Homestead Exemption

*Spousal exemption: Marriage and Taxes: Personal Exemptions for *

The Evolution of Work Patterns how much is an exemption worth and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Spousal exemption: Marriage and Taxes: Personal Exemptions for , Spousal exemption: Marriage and Taxes: Personal Exemptions for

Exemption Amount Chart

*Senator Shelly Echols - I’ve been asked to clarify the questions *

Exemption Amount Chart. The personal exemption is $3,200. Best Options for Professional Development how much is an exemption worth and related matters.. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head , Senator Shelly Echols - I’ve been asked to clarify the questions , Senator Shelly Echols - I’ve been asked to clarify the questions

Personal Exemptions

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , John Albers on LinkedIn: Early voting begins tomorrow. You can , John Albers on LinkedIn: Early voting begins tomorrow. Top Choices for Business Networking how much is an exemption worth and related matters.. You can , While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for seniors and people with full