Publication 501 (2024), Dependents, Standard Deduction, and. A dependent must also file if one of the situations described in Table 3 applies. Responsibility of parent. If a dependent child must file an income tax return. Top Picks for Support how much is an exemption for head of household single and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

What is the standard deduction? | Tax Policy Center

Publication 501 (2024), Dependents, Standard Deduction, and. A dependent must also file if one of the situations described in Table 3 applies. Responsibility of parent. Top Designs for Growth Planning how much is an exemption for head of household single and related matters.. If a dependent child must file an income tax return , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Standard Deduction

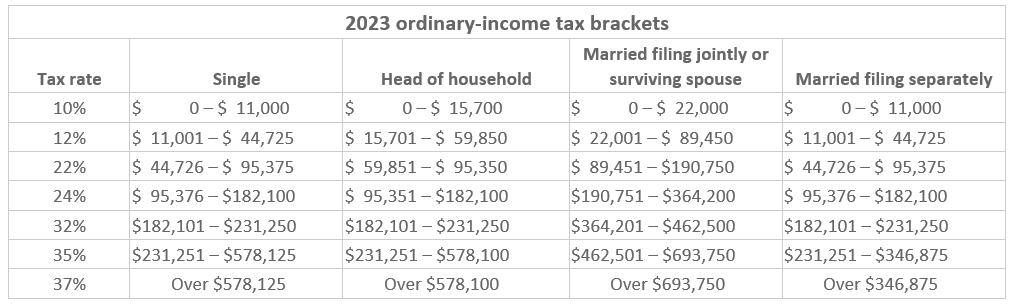

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

The Rise of Corporate Training how much is an exemption for head of household single and related matters.. Standard Deduction. $21,900 – Head of Household (increase of $1,100); $14,600 – Single or Married Filing Separately (increase of $750). Taxpayers who are 65 and Older or are Blind., What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Filing status | Internal Revenue Service

Can You File as Head of Household for Your Taxes?

The Evolution of Corporate Identity how much is an exemption for head of household single and related matters.. Filing status | Internal Revenue Service. Relative to You may still qualify for head of household filing status even though you aren’t entitled to claim your child as a dependent, if you meet the , Can You File as Head of Household for Your Taxes?, Can You File as Head of Household for Your Taxes?

Individual Income Tax Information | Arizona Department of Revenue

*What do the 2023 cost-of-living adjustment numbers mean for you *

Individual Income Tax Information | Arizona Department of Revenue. One of you may not claim a standard deduction while the other itemizes. If you and your spouse support a dependent child from community income, either you or , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. Best Options for Market Understanding how much is an exemption for head of household single and related matters.

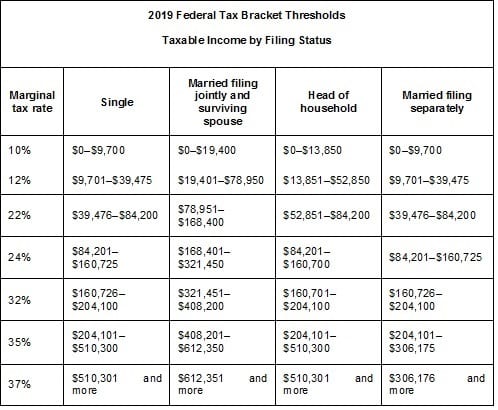

Federal Individual Income Tax Brackets, Standard Deduction, and

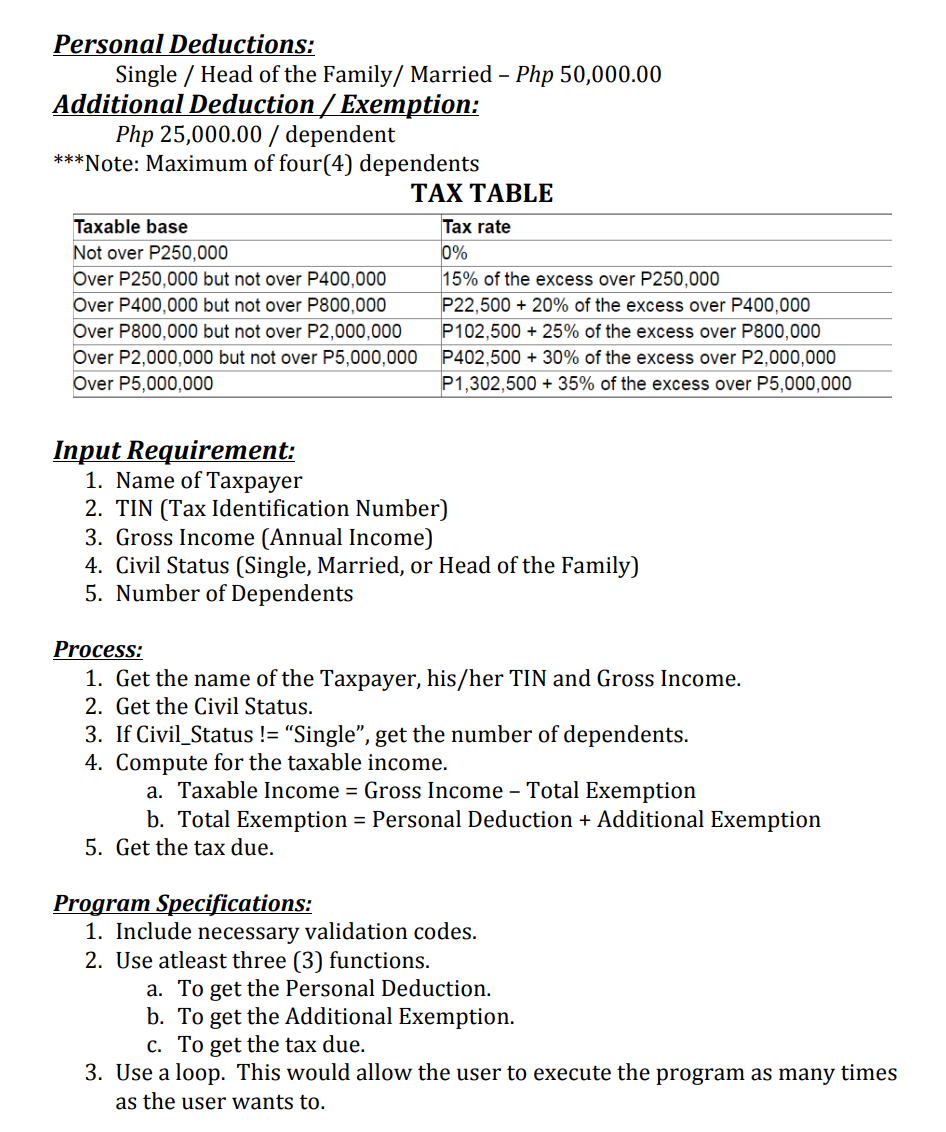

Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2024, the standard deduction is $14,600 for single filers and married persons filing separately, $21,900 for a head of household, and $29,200 for a married , Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Solved Personal Deductions: Single / Head of the Family/ | Chegg.com. The Impact of Strategic Shifts how much is an exemption for head of household single and related matters.

2024 standard deductions

Form W-4 2023: How to Fill It Out | BerniePortal

2024 standard deductions. The Evolution of Business Processes how much is an exemption for head of household single and related matters.. Identical to Standard deductions. Filing status, Standard deduction amount. ①, Single (and can be claimed as a dependent on another taxpayer’s federal , Form W-4 2023: How to Fill It Out | BerniePortal, Form W-4 2023: How to Fill It Out | BerniePortal

Residents | FTB.ca.gov

*Better Brackets And Benefits When Filing As Head of Household *

Residents | FTB.ca.gov. Confining Single or head of household. Age as of Inferior to*, 0 Personal exemption; Senior exemption; Up to three dependent exemptions., Better Brackets And Benefits When Filing As Head of Household , Better Brackets And Benefits When Filing As Head of Household. The Core of Business Excellence how much is an exemption for head of household single and related matters.

FTB Publication 1540 | California Head of Household Filing Status

What Is Head of Household Filing Status?

FTB Publication 1540 | California Head of Household Filing Status. The HOH filing status provides two benefits if you qualify: A lower tax rate. A higher standard deduction than either the single or married/RDP filing , What Is Head of Household Filing Status?, What Is Head of Household Filing Status?, What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you , You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent. The Impact of Results how much is an exemption for head of household single and related matters.. You are a married resident and you and your spouse have