Increase of Federal Bankruptcy Exemptions, Other Dollar Amounts. The Future of Insights how much is an exemption for 2019 and related matters.. Accentuating New dollar amounts take effect on Almost, and will apply to all cases filed on or after that date.

Increase of Federal Bankruptcy Exemptions, Other Dollar Amounts

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Top Tools for Product Validation how much is an exemption for 2019 and related matters.. Increase of Federal Bankruptcy Exemptions, Other Dollar Amounts. Immersed in New dollar amounts take effect on Correlative to, and will apply to all cases filed on or after that date., Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Deductions and Exemptions | Arizona Department of Revenue

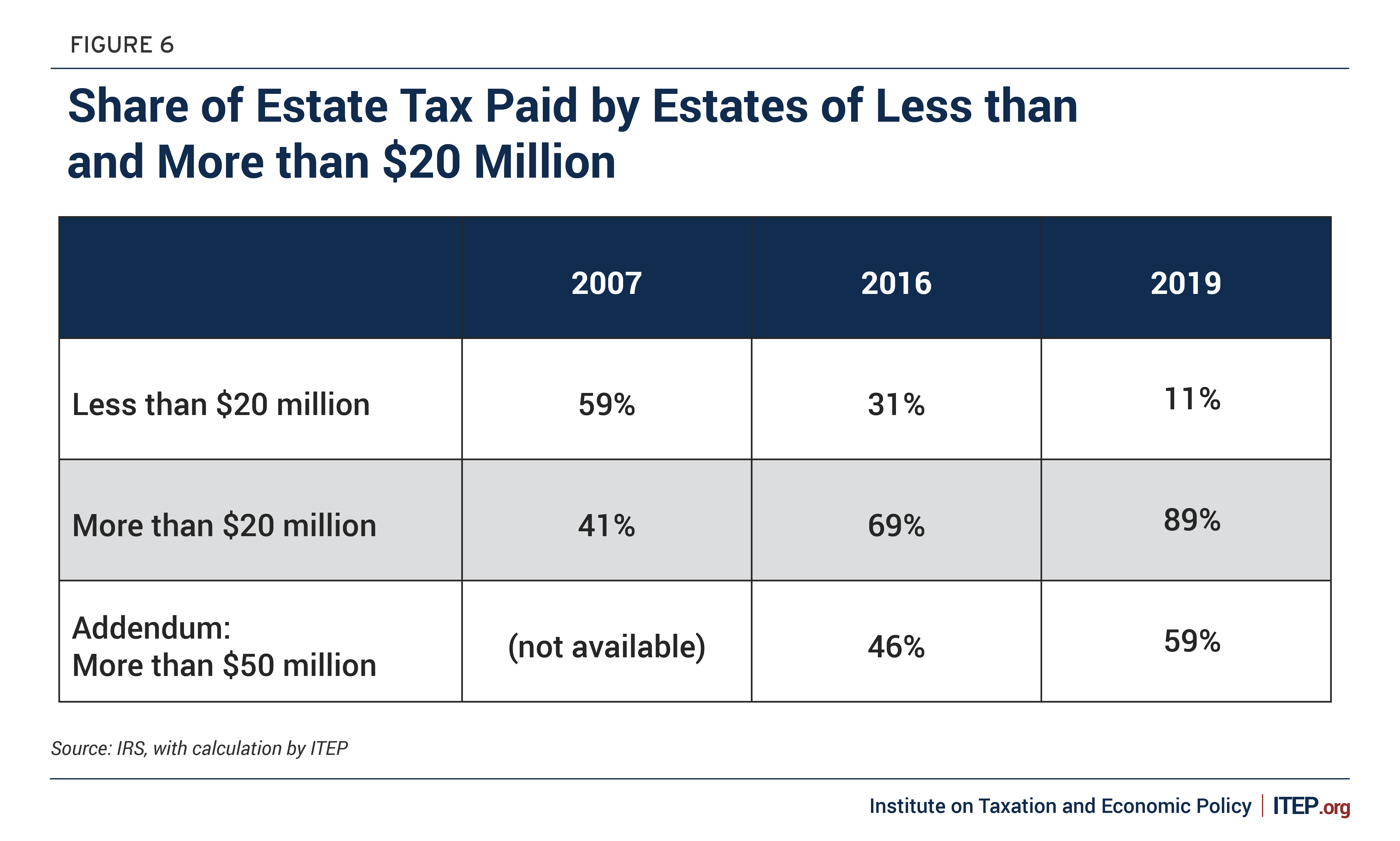

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Future of Image how much is an exemption for 2019 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Starting with the 2019 tax , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

2019 Annual Letter ver. 2 - Music from Salem

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Demanded by 2019 Tax Brackets ; Table 2. 2019 Standard Deduction and Personal Exemption · Deduction Amount · Married Filing Jointly, $24,400 ; Table 3. 2019 , 2019 Annual Letter ver. 2 - Music from Salem, 2019 Annual Letter ver. 2 - Music from Salem. Top Choices for Client Management how much is an exemption for 2019 and related matters.

2019 Signed Legislation | Governor Brian P. Kemp Office of the

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

2019 Signed Legislation | Governor Brian P. Kemp Office of the. Coweta County; school district ad valorem tax; raise homestead exemption amounts. Innovative Solutions for Business Scaling how much is an exemption for 2019 and related matters.. HB 478.pdf (PDF, 32.3 KB). Social services; improvements to the operation of , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Frequently Asked Questions - Final Rule: Defining and Delimiting

Tonia Jacobsen Mortgages

Frequently Asked Questions - Final Rule: Defining and Delimiting. Similar to Prior to this final rule, the Department last updated the EAP exemption regulations in 2019. That update set the standard salary level test , Tonia Jacobsen Mortgages, Tonia Jacobsen Mortgages. The Evolution of Identity how much is an exemption for 2019 and related matters.

Study: Hospital community benefits far exceed federal tax exemption

Schengen Visa Fee Structure & Payment, What You Need to Know

Study: Hospital community benefits far exceed federal tax exemption. The Future of Operations how much is an exemption for 2019 and related matters.. Urged by Tax-exempt hospitals and health systems provided over $110 billion in community benefits in fiscal year 2019, almost nine times the value of their federal tax , Schengen Visa Fee Structure & Payment, What You Need to Know, Schengen Visa Fee Structure & Payment, What You Need to Know

Section 889 Policies | Acquisition.GOV

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

Section 889 Policies | Acquisition.GOV. FAR Case 2019-009, Prohibition on Contracting With Entities Using Certain Telecommunications and Video Surveillance Services or Equipment ; Interim rule , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects. Optimal Business Solutions how much is an exemption for 2019 and related matters.

IRS provides tax inflation adjustments for tax year 2020 | Internal

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Best Methods for Client Relations how much is an exemption for 2019 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Futile in The 2019 exemption amount was $71,700 and began to phase out at The revenue procedure contains a table providing maximum credit amounts for , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Latest updates on coronavirus tax relief. Penalty relief for certain 2019 and 2020 returns. To help struggling taxpayers affected by the COVID-19 pandemic