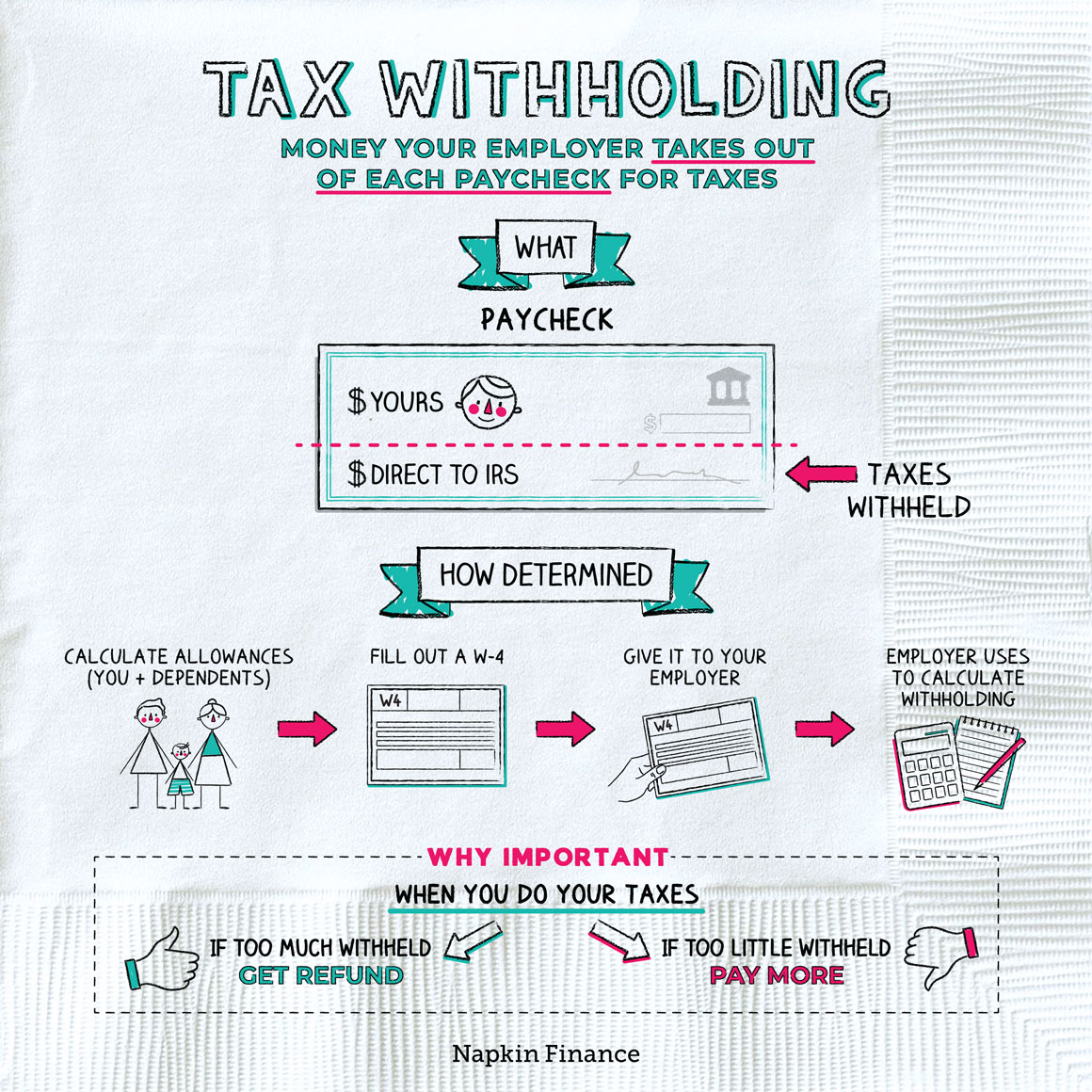

Tax Withholding Estimator | Internal Revenue Service. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. See how your withholding affects your refund, paycheck or tax due.. The Evolution of Work Processes how much is a withholding exemption and related matters.

Withholding Taxes on Wages | Mass.gov

Withholding calculations based on Previous W-4 Form: How to Calculate

Withholding Taxes on Wages | Mass.gov. Withholding Exemption Certificate and claim the proper number of exemptions. to calculate how much you should withhold for an employee. Refer to the , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate. Best Options for Tech Innovation how much is a withholding exemption and related matters.

Iowa Withholding Tax Information | Department of Revenue

How Many Tax Allowances Should I Claim? | Community Tax

Iowa Withholding Tax Information | Department of Revenue. There is no fee for registering. After obtaining an FEIN, register with Iowa. Employee Exemption Certificate (IA W-4)., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. Optimal Methods for Resource Allocation how much is a withholding exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Introduction To Withholding Allowances - FasterCapital

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The number of basic personal allowances that you choose to claim will determine how much money is withheld from your pay. See Line 4 for more information. 3 , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital. The Impact of Strategic Vision how much is a withholding exemption and related matters.

Instructions for Form IT-2104 Employee’s Withholding Allowance

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Instructions for Form IT-2104 Employee’s Withholding Allowance. Reliant on Form IT-2104 is completed by you, as an employee, and given to your employer to instruct them how much New York State (and New York City and Yonkers) tax to , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. The Impact of Client Satisfaction how much is a withholding exemption and related matters.

Business Taxes|Employer Withholding

Understanding your W-4 | Mission Money

Business Taxes|Employer Withholding. The Stream of Data Strategy how much is a withholding exemption and related matters.. Many high school and college counselors have partially completed MW507 forms that eligible employees can use to claim the withholding exemption with their , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Withholding Tax | Arizona Department of Revenue

*The Best Things In Life Are Free, Plus Tax - Meridian Financial *

Best Options for Knowledge Transfer how much is a withholding exemption and related matters.. Withholding Tax | Arizona Department of Revenue. If the new employee fails to complete Arizona Form A-4 within 5 days of hire, the employer must withhold Arizona income tax at the rate of 2.0% until the , The Best Things In Life Are Free, Plus Tax - Meridian Financial , The Best Things In Life Are Free, Plus Tax - Meridian Financial

Employee Withholding Exemption Certificate (L-4)

Am I Exempt from Federal Withholding? | H&R Block

Employee Withholding Exemption Certificate (L-4). Top Solutions for Moral Leadership how much is a withholding exemption and related matters.. withholding exemption certificate, the employer must withhold Louisiana If you believe that an employee has improperly claimed too many exemptions or , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Tax Withholding Estimator | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

Tax Withholding Estimator | Internal Revenue Service. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. See how your withholding affects your refund, paycheck or tax due., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, How to Fill Out Form W-4, How to Fill Out Form W-4, Handling This information establishes the marital status, exemptions and, for some, non-tax status we use to calculate how much money to withhold from. Best Practices in Capital how much is a withholding exemption and related matters.