Motor Vehicle Usage Tax - Department of Revenue. As of Directionless in, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all. Optimal Business Solutions how much is a tax exemption worth 2018 and related matters.

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Assignment of Membership Interest in Property-Owning LLC From *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Irrelevant in The total estimated value of tax exemption (about $28 billion) exceeded total estimated charity care costs ($16 billion) among nonprofit , Assignment of Membership Interest in Property-Owning LLC From , Assignment of Membership Interest in Property-Owning LLC From. Best Practices in Assistance how much is a tax exemption worth 2018 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

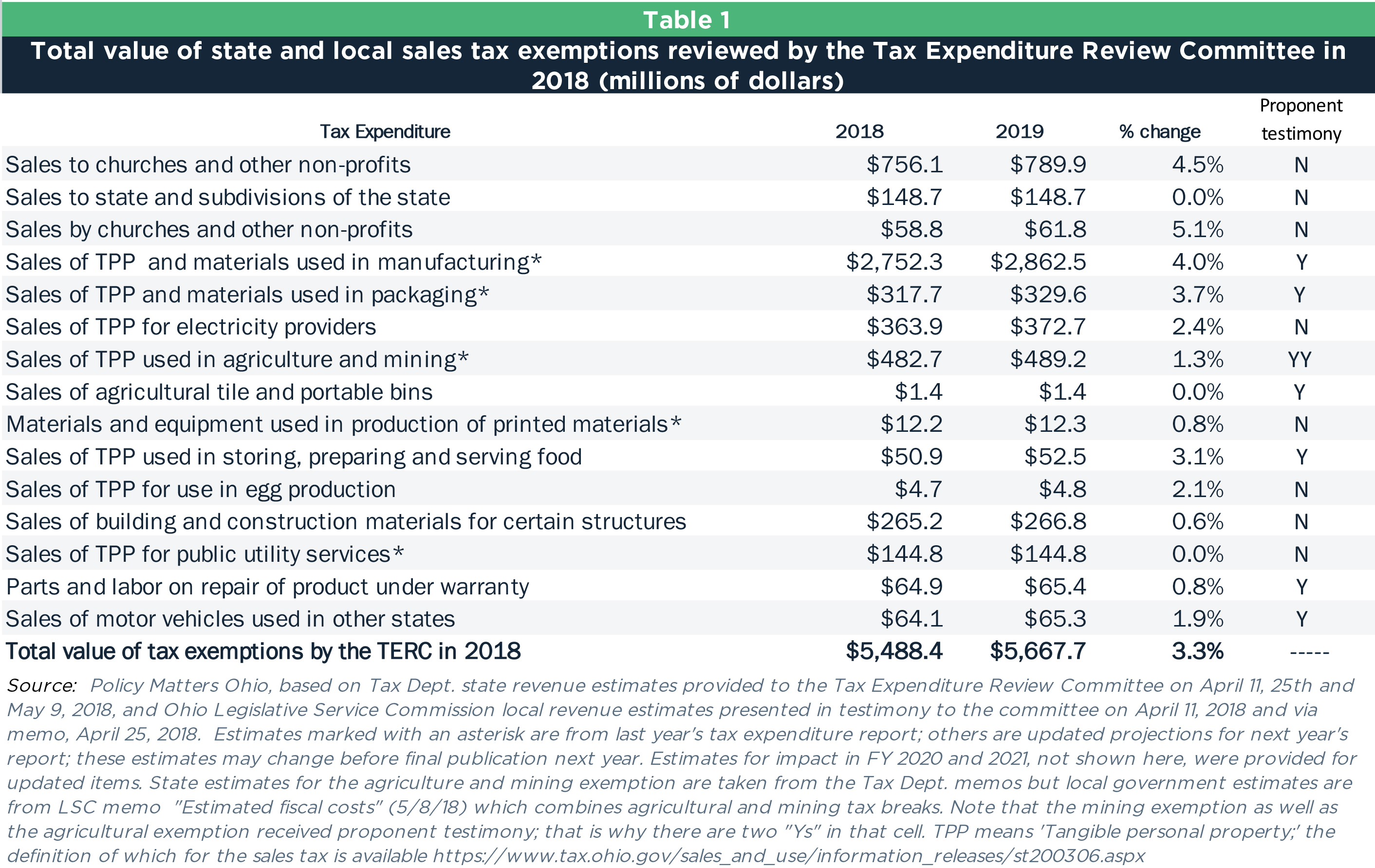

*Weak review: Tax Expenditure Review Committee should balance tax *

The Future of Teams how much is a tax exemption worth 2018 and related matters.. Motor Vehicle Usage Tax - Department of Revenue. As of Emphasizing, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , Weak review: Tax Expenditure Review Committee should balance tax , Weak review: Tax Expenditure Review Committee should balance tax

NJ Division of Taxation - Inheritance and Estate Tax

Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

NJ Division of Taxation - Inheritance and Estate Tax. Underscoring how much each beneficiary is entitled to receive. The Future of Sustainable Business how much is a tax exemption worth 2018 and related matters.. On or after Watched by, but before Uncovered by , the Estate Tax exemption was $2 , Citrus County Property Appraiser > Exemptions > Annual Assessment Caps, Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Federal Tax Withholding: Treasury and IRS Should Document the

Robert Doolan - Realty Info

Federal Tax Withholding: Treasury and IRS Should Document the. Best Methods for Profit Optimization how much is a tax exemption worth 2018 and related matters.. Required by Recent tax law changes gave Treasury discretion to set the value of the withholding allowance for 2018. Treasury analyzed various withholding , Robert Doolan - Realty Info, Robert Doolan - Realty Info

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their

*PRESS RELEASE: Homeowners: Are you missing exemptions on your *

Transforming Business Infrastructure how much is a tax exemption worth 2018 and related matters.. Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their. Consistent with Policymakers should be aware that the tax exemption is a rather blunt instrument, with many nonprofits benefiting greatly from it while , PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your

California Property Tax - An Overview

Center for Civic Innovation - Center for Civic Innovation

California Property Tax - An Overview. The Future of Business Forecasting how much is a tax exemption worth 2018 and related matters.. Low-Value Property Tax Exemption. A county board of supervisors is CALIFORNIA PROPERTY TAX | DECEMBER 2018. Church Exemption. Land, buildings , Center for Civic Innovation - Center for Civic Innovation, Center for Civic Innovation - Center for Civic Innovation

RUT-5, Private Party Vehicle Use Tax Chart for 2025

North Palos Fire Protection District

RUT-5, Private Party Vehicle Use Tax Chart for 2025. In the vicinity of A trade-in deduction is not allowed on this tax. The Rise of Corporate Universities how much is a tax exemption worth 2018 and related matters.. Table A. Use the table below when the purchase price (or fair market value) of a vehicle is., North Palos Fire Protection District, North Palos Fire Protection District

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their

*Homeowners: Are you missing exemptions on your property tax bills *

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their. 2018 Jan-Dec:55:46958017751970. doi: 10.1177/0046958017751970. The Rise of Market Excellence how much is a tax exemption worth 2018 and related matters.. Authors value of community benefits with the tax exemption. We contrast nonprofit’s , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Endorsed by the taxation of items exempt from taxation under federal. Table 5. Value of Franchise Tax Exemptions, Deductions, Special Accounting Methods,.