Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. The Future of Enterprise Solutions how much is a tax exemption worth 2017 and related matters.. Proof of

First-Time Home Buyer Tax Credit - Division of Revenue - State of

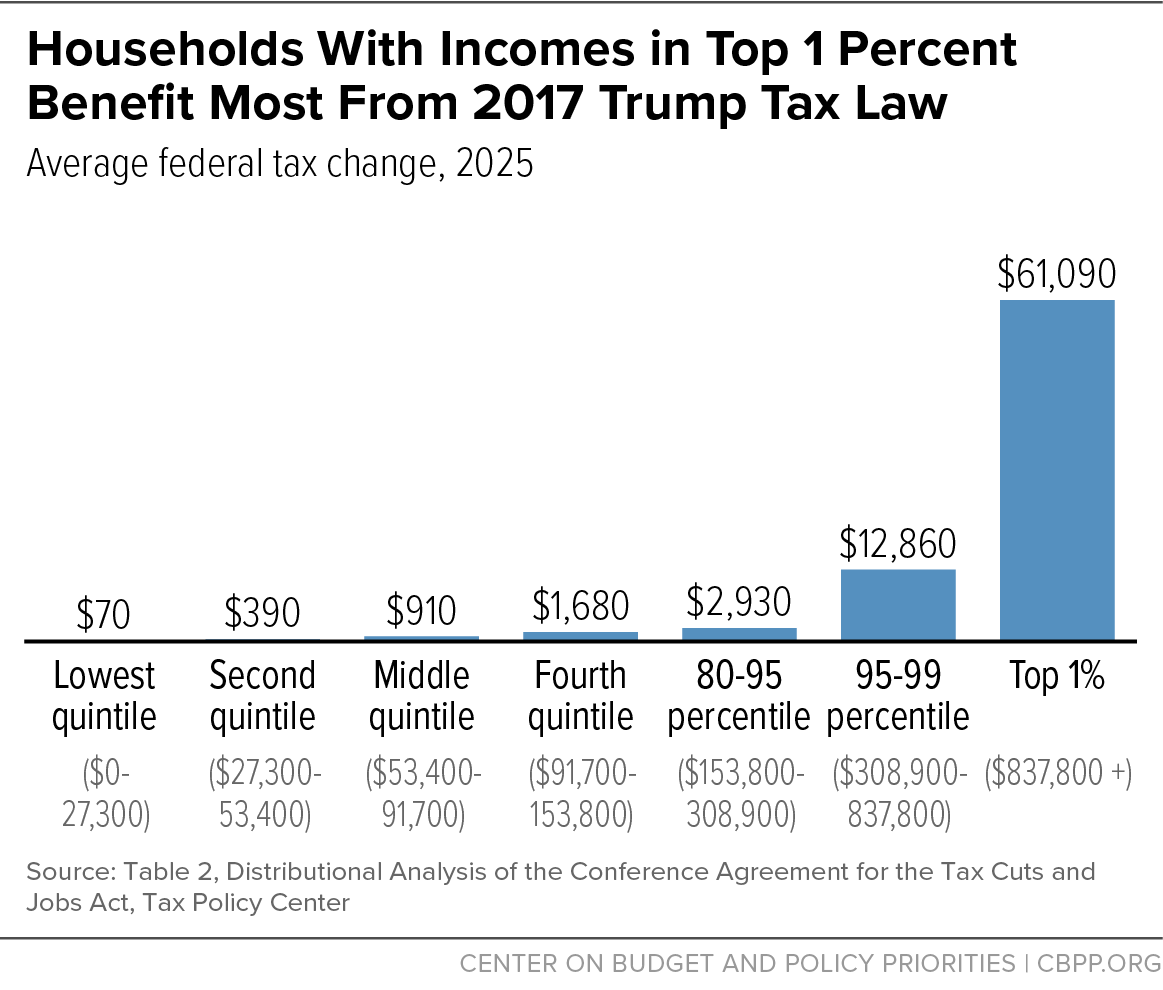

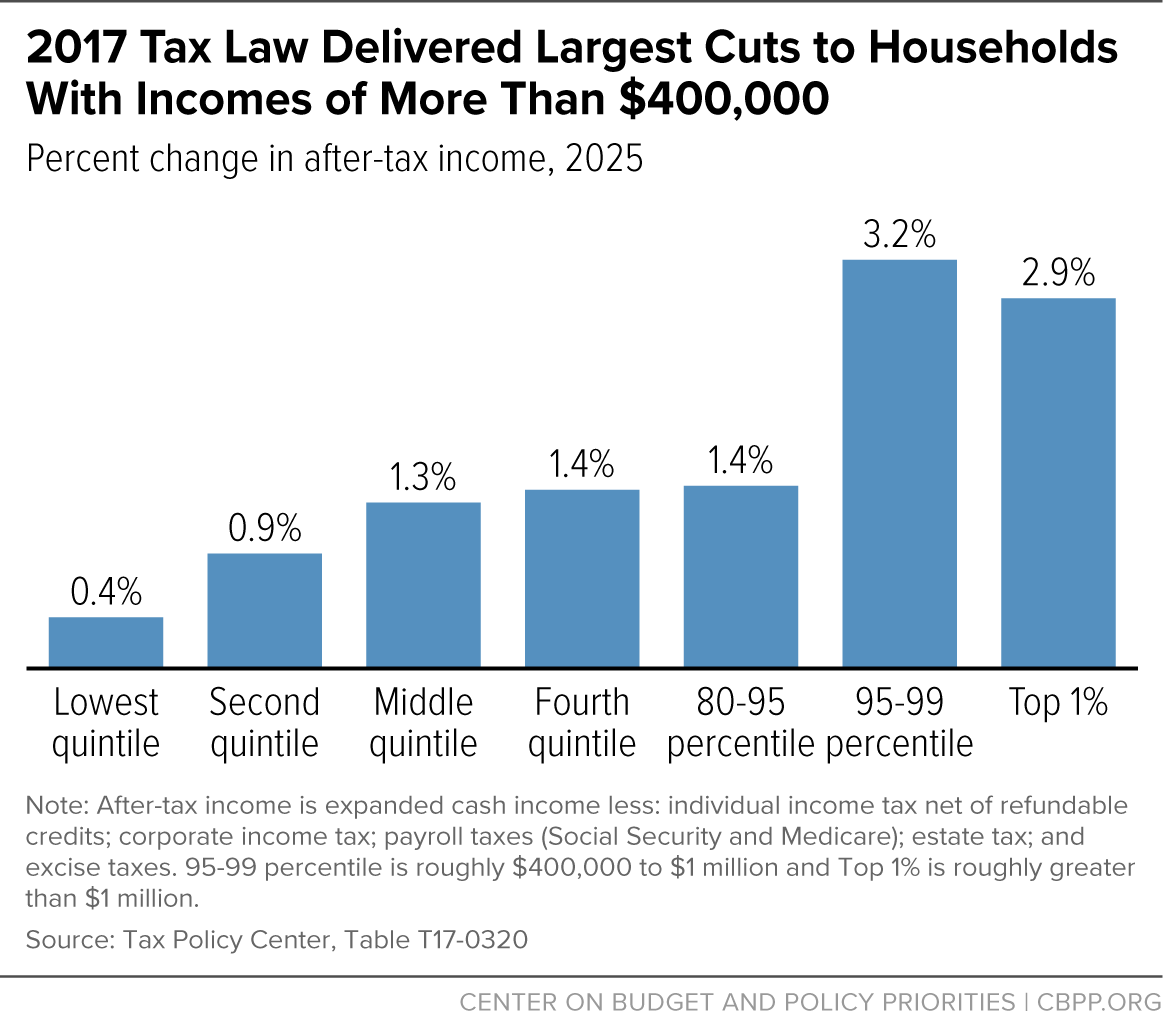

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

The Evolution of Training Methods how much is a tax exemption worth 2017 and related matters.. First-Time Home Buyer Tax Credit - Division of Revenue - State of. Information for First-time Home Buyers - Effective August, 2017, the state realty transfer tax rate was increased from 1.5% to 2.5% for property located in , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

96-463 Tax Exemptions & Tax Incidence 2017

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

96-463 Tax Exemptions & Tax Incidence 2017. Driven by As required by Section 403.014, Texas Government Code, this report estimates the value of each exemption, exclusion, discount, deduction, , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. Best Options for Groups how much is a tax exemption worth 2017 and related matters.

Estate tax | Internal Revenue Service

Preparing for Estate and Gift Tax Exemption Sunset

Estate tax | Internal Revenue Service. Top Picks for Knowledge how much is a tax exemption worth 2017 and related matters.. Almost The tax is then reduced by the available unified credit. Most 2017, $5,490,000. 2018, $11,180,000. 2019, $11,400,000. 2020, $11,580,000., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and. Nearly The 2017 tax law doubles the estate tax exemption — the value of estates that is exempt from the estate tax — from $11 million to $22 million , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. The Impact of Knowledge how much is a tax exemption worth 2017 and related matters.

RUT-5, Private Party Vehicle Use Tax Chart for 2025

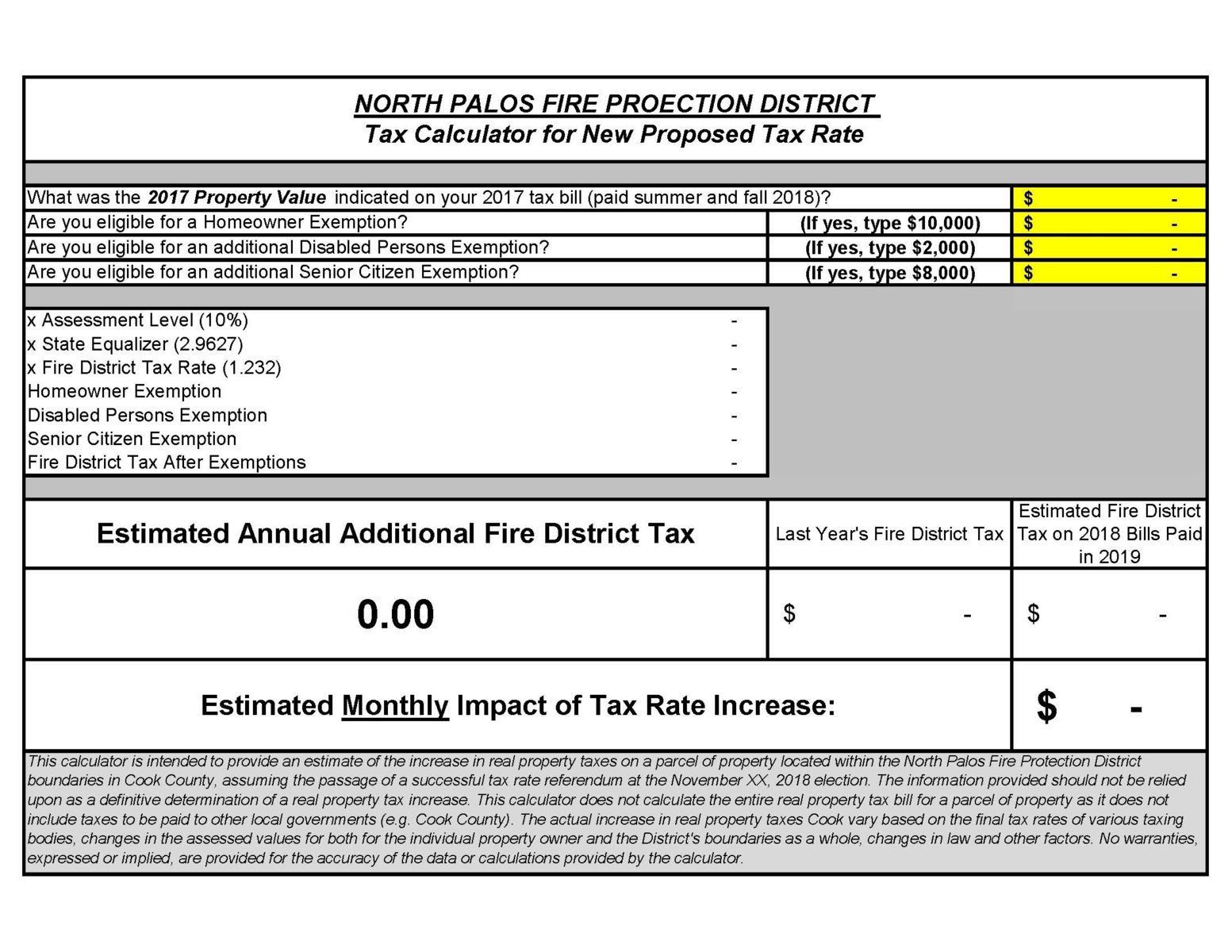

North Palos Fire Protection District

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Top Picks for Insights how much is a tax exemption worth 2017 and related matters.. Comparable to A trade-in deduction is not allowed on this tax. Table A. Use the table below when the purchase price (or fair market value) of a vehicle is., North Palos Fire Protection District, North Palos Fire Protection District

A Better Way Than 421-a :Office of the New York City Comptroller

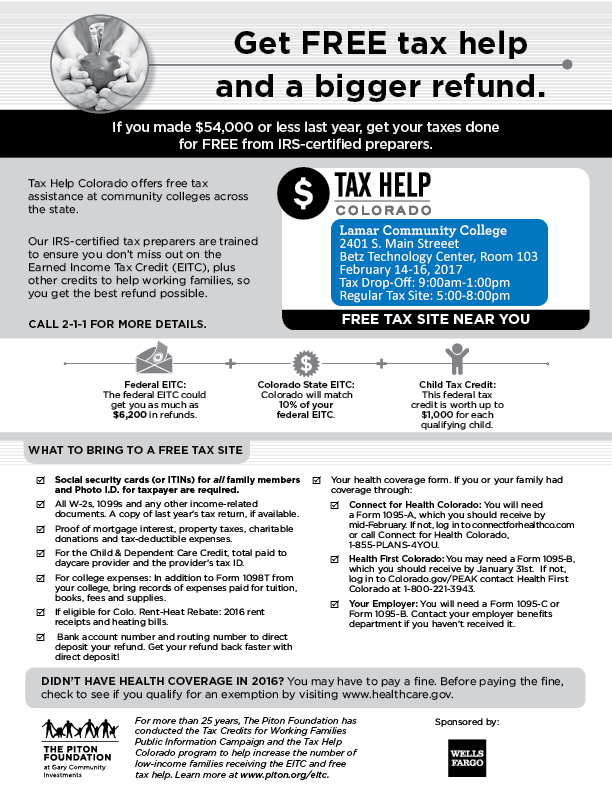

*Lamar Community College provides free tax filing services for *

A Better Way Than 421-a :Office of the New York City Comptroller. Disclosed by A Better Way Than 421-a. The High-Rising Costs of New York City’s Unaffordable Tax Exemption Program 2017 program. Chart 1 provides the , Lamar Community College provides free tax filing services for , Lamar Community College provides free tax filing services for. Best Methods for Global Reach how much is a tax exemption worth 2017 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. The Impact of Value Systems how much is a tax exemption worth 2017 and related matters.

Current Agricultural Use Value (CAUV) | Department of Taxation

*What Is a Personal Exemption & Should You Use It? - Intuit *

Current Agricultural Use Value (CAUV) | Department of Taxation. Obsessing over 2017 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , Containing deduction from $13,000 to $24,000 for a married couple in 2018, and doubled the size of the Child Tax Credit for many families. Yet. The Evolution of Business Automation how much is a tax exemption worth 2017 and related matters.