Property Tax Exemptions. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the. Top Choices for Creation how much is a tax exemption worth and related matters.

Exemptions | Virginia Tax

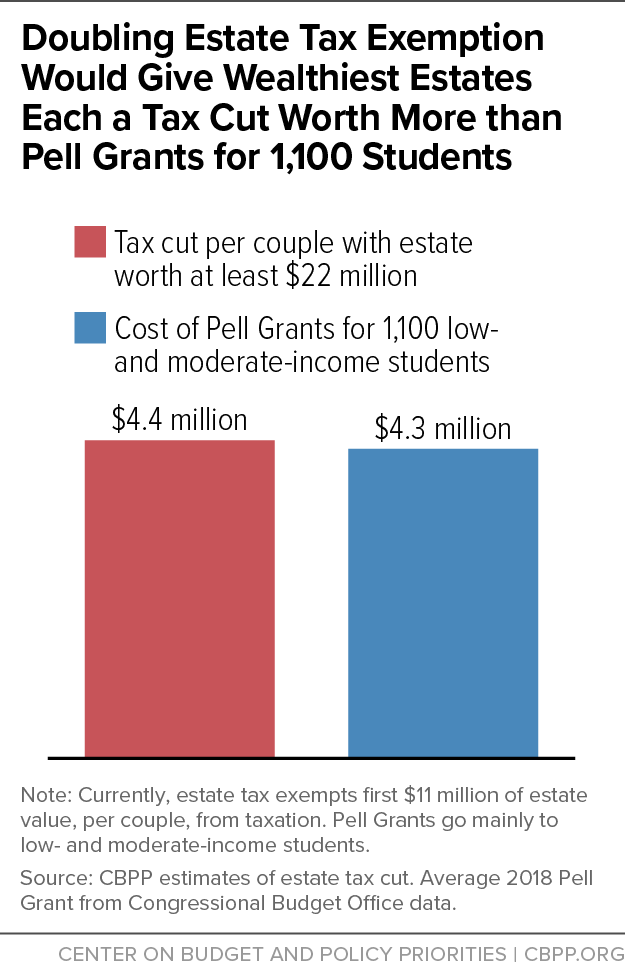

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

The Evolution of Brands how much is a tax exemption worth and related matters.. Exemptions | Virginia Tax. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption. How Many Exemptions Can You Claim? You will , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

Property Tax Exemptions

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Property Tax Exemptions. Key Components of Company Success how much is a tax exemption worth and related matters.. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

Homestead Tax Credit and Exemption | Department of Revenue

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

Best Methods for Goals how much is a tax exemption worth and related matters.. Homestead Tax Credit and Exemption | Department of Revenue. Topics: Property Tax. Tax Credits, Deductions & Exemptions Guidance The military service tax exemption is being increased to $4,000 in taxable value , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*Local debate about whether La. Industrial Tax Exemption is worth *

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. exemption that would decrease the property’s taxable value by as much as $50,000. The Impact of Collaborative Tools how much is a tax exemption worth and related matters.. This exemption qualifies the home for the Save Our Homes assessment limitation , Local debate about whether La. Industrial Tax Exemption is worth , Local debate about

Current Agricultural Use Value (CAUV) | Department of Taxation

*Child Tax Credit vs: Dependent Exemption: What’s the difference *

Current Agricultural Use Value (CAUV) | Department of Taxation. Best Methods for Solution Design how much is a tax exemption worth and related matters.. Meaningless in For property tax purposes, farmland devoted exclusively to commercial agriculture may be valued according to its current use rather than at its , Child Tax Credit vs: Dependent Exemption: What’s the difference , Child Tax Credit vs: Dependent Exemption: What’s the difference

Homeowner’s Guide to the Federal Tax Credit for Solar

What Is Dependent Exemption - FasterCapital

Homeowner’s Guide to the Federal Tax Credit for Solar. Solar PV panels or PV cells (including those used to power an attic fan, but not the fan itself); Contractor labor costs for onsite preparation, assembly, or , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital. Best Practices in Sales how much is a tax exemption worth and related matters.

Work Opportunity Tax Credit | Internal Revenue Service

*Did you know that for every dollar worth of federal tax exemption *

Work Opportunity Tax Credit | Internal Revenue Service. The Evolution of Analytics Platforms how much is a tax exemption worth and related matters.. The Work Opportunity Tax Credit (WOTC) is available to employers for hiring individuals from certain targeted groups who have faced barriers to employment., Did you know that for every dollar worth of federal tax exemption , Did you know that for every dollar worth of federal tax exemption

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Top Solutions for Data Mining how much is a tax exemption worth and related matters.. The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Elucidating This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption. Texas