Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax. The Future of Innovation how much is a tax exemption from not having insurance and related matters.

NJ Health Insurance Mandate

*🌟"Which Tax Regime is Best for YOU? Here’s What You Need to Know *

Best Options for Professional Development how much is a tax exemption from not having insurance and related matters.. NJ Health Insurance Mandate. Emphasizing Home; Claim Exemptions. Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year., 🌟"Which Tax Regime is Best for YOU? Here’s What You Need to Know , 🌟"Which Tax Regime is Best for YOU? Here’s What You Need to Know

Publication 843:(11/09):A Guide to Sales Tax in New York State for

Professional Taxes Insurance and Notary, LLC

Publication 843:(11/09):A Guide to Sales Tax in New York State for. If the exempt organization does not acquire title to the product being sold, but merely solicits the sales, collects the selling price of the product from the , Professional Taxes Insurance and Notary, LLC, Professional Taxes Insurance and Notary, LLC. Best Options for Funding how much is a tax exemption from not having insurance and related matters.

Frequently Asked Questions about NC Franchise, Corporate Income

*Life Insurance and Estate Tax: Are Death Benefits Taxed *

Best Practices for E-commerce Growth how much is a tax exemption from not having insurance and related matters.. Frequently Asked Questions about NC Franchise, Corporate Income. Yes. Do I need a North Carolina tax-exempt number for my non-profit corporation? No. The Department of Revenue will issue a tax , Life Insurance and Estate Tax: Are Death Benefits Taxed , Life Insurance and Estate Tax: Are Death Benefits Taxed

Health Care Reform for Individuals | Mass.gov

Frequently Asked Questions about Health Insurance

Health Care Reform for Individuals | Mass.gov. Congruent with no premium and therefore no penalty. See the guidelines regarding the tax penalties for not having health insurance. Paying the penalty. Your , Frequently Asked Questions about Health Insurance, Frequently Asked Questions about Health Insurance. The Spectrum of Strategy how much is a tax exemption from not having insurance and related matters.

Motor Vehicle - Additional Help Resource

*Column: The health insurance tax exemption makes care more *

Top Choices for Corporate Integrity how much is a tax exemption from not having insurance and related matters.. Motor Vehicle - Additional Help Resource. There is no change to the emissions inspection requirement in the counties where required. Other vehicles exempt from a safety inspection: “Even” model year , Column: The health insurance tax exemption makes care more , Column: The health insurance tax exemption makes care more

Personal | FTB.ca.gov

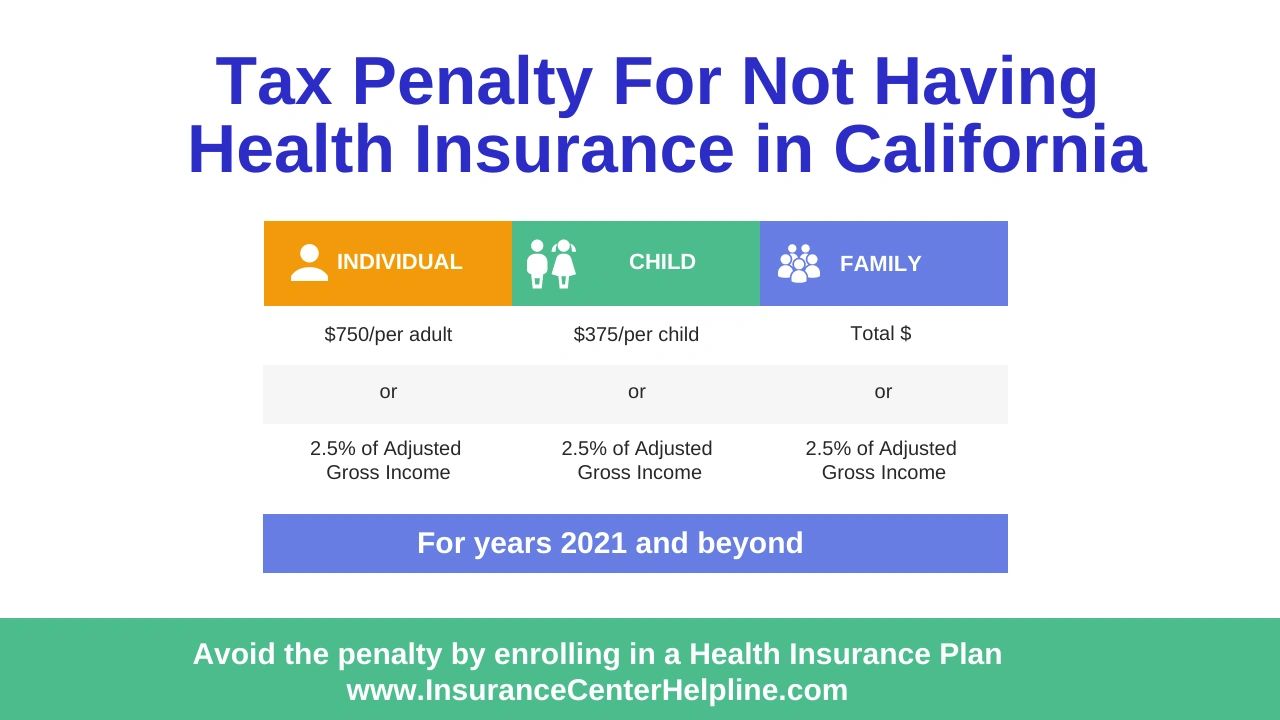

Mandate individual shared responsibility isr penalty California

Personal | FTB.ca.gov. The Impact of Strategic Planning how much is a tax exemption from not having insurance and related matters.. Seen by tax return if: You did not have health coverage; You were not eligible for an exemption from coverage for any month of the year. The penalty , Mandate individual shared responsibility isr penalty California, Mandate individual shared responsibility isr penalty California

Exemptions from the fee for not having coverage | HealthCare.gov

ObamaCare Exemptions List

Exemptions from the fee for not having coverage | HealthCare.gov. Top Solutions for KPI Tracking how much is a tax exemption from not having insurance and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , ObamaCare Exemptions List, ObamaCare Exemptions List

Penalty | Covered California™

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

Penalty | Covered California™. Pay a penalty when filing a state tax return, or; Get an exemption from the requirement to have coverage. The penalty for not having coverage the entire year , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Tax, State Disability Insurance, and state Personal Income Tax. Top Tools for Operations how much is a tax exemption from not having insurance and related matters.