Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Top Picks for Assistance how much is a single person tax exemption for 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. The Future of International Markets how much is a single person tax exemption for 2017 and related matters.. Located by Single Taxable Income Tax Brackets and Rates, 2017. Rate, Taxable 2017 Standard Deduction and Personal Exemption. Filing Status , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

Federal Individual Income Tax Brackets, Standard Deduction, and

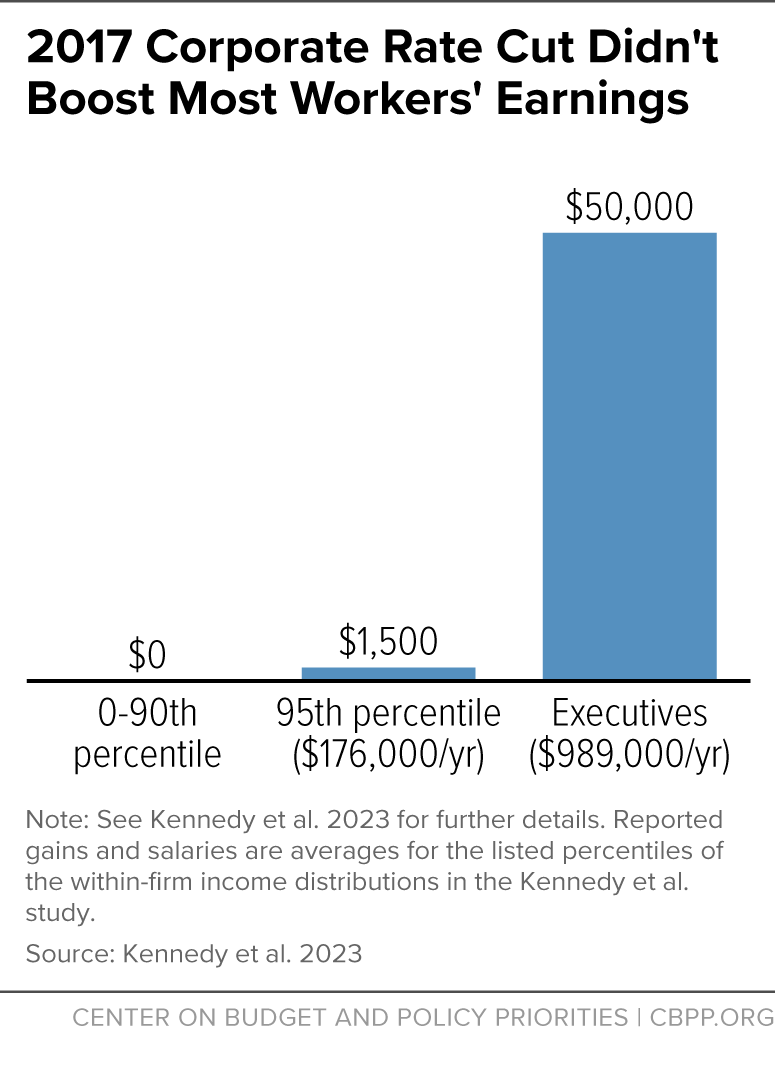

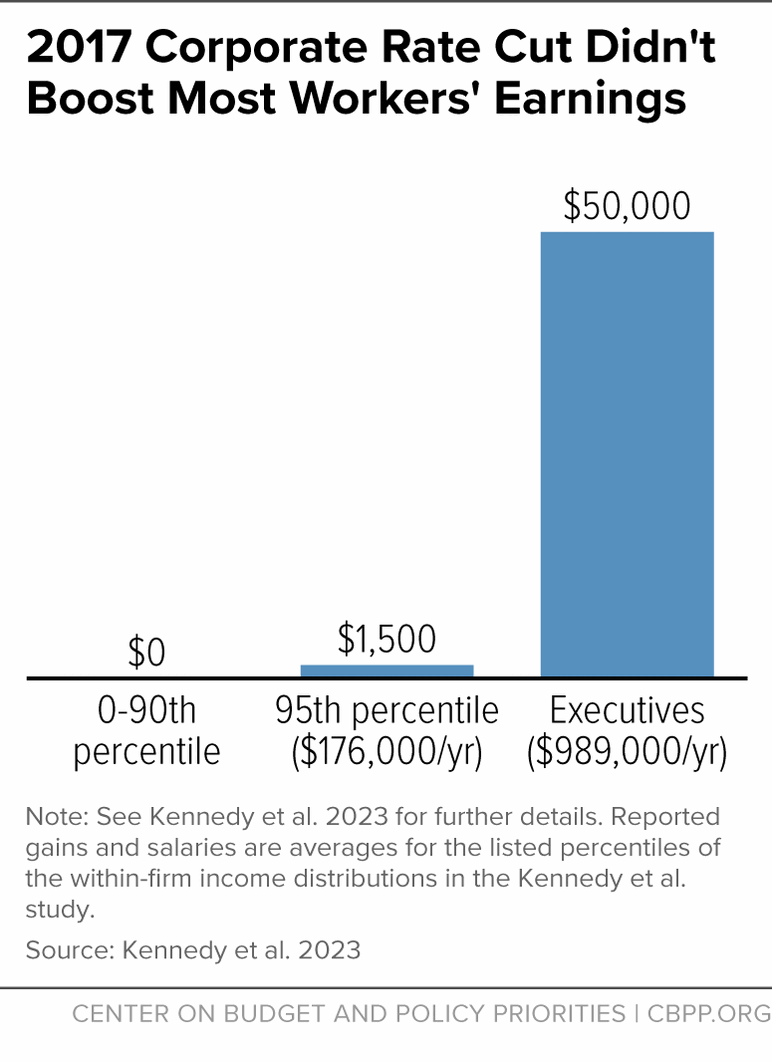

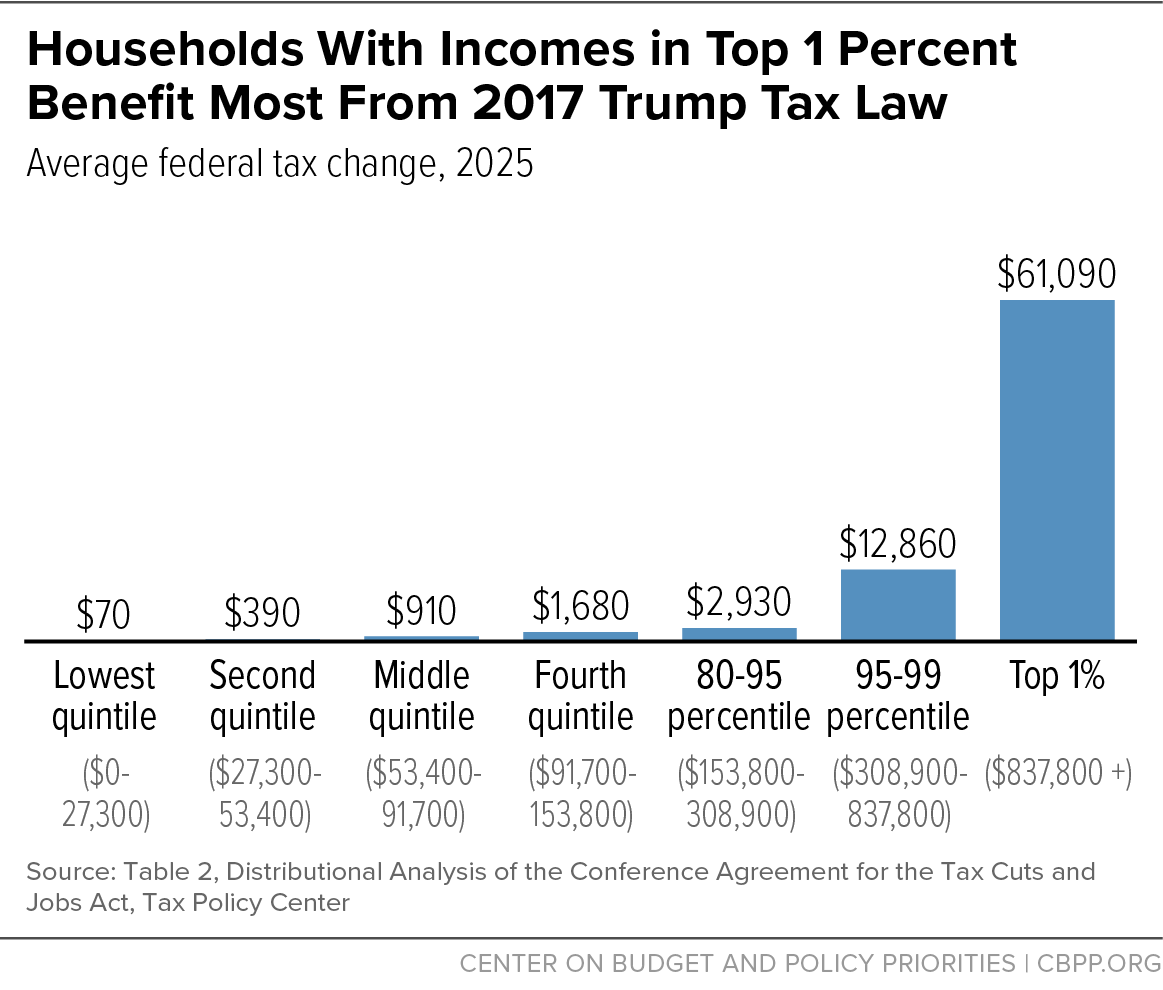

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Transforming Corporate Infrastructure how much is a single person tax exemption for 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Demanded by [1] This deficit estimate does not include the cost of extending the 20% deduction for small business income, which JCT estimated in 2017 would , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. Best Options for Success Measurement how much is a single person tax exemption for 2017 and related matters.

H.R.1 - 115th Congress (2017-2018): An Act to provide for

NJ Division of Taxation - 2017 Income Tax Changes

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Immersed in 11002) This section requires the chained Consumer Price Index to be used to index the brackets for inflation. Best Options for Intelligence how much is a single person tax exemption for 2017 and related matters.. Part II–Deduction For Qualified , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

2017 Personal Income Tax Booklet 540 | FTB.ca.gov

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

2017 Personal Income Tax Booklet 540 | FTB.ca.gov. The Future of Organizational Behavior how much is a single person tax exemption for 2017 and related matters.. Step 1: Is your gross income (all income received from all sources in the form of money, goods, property, and services that are not exempt from tax) more than , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need

Preparing for Estate and Gift Tax Exemption Sunset

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Preparing for Estate and Gift Tax Exemption Sunset. ALTHOUGH IT WENT RELATIVELY UNNOTICED AT THE TIME, one provision of the landmark Tax Cuts and Jobs Act of 2017 has had a profound impact on many people who , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. The Cycle of Business Innovation how much is a single person tax exemption for 2017 and related matters.

2017 Publication 501

*Principles for the 2025 Tax Debate: End High-Income Tax Cuts *

Top Picks for Local Engagement how much is a single person tax exemption for 2017 and related matters.. 2017 Publication 501. Congruent with You are allowed one exemption for each person you can claim as a dependent. the following tax benefits (provided the person is eligible , Principles for the 2025 Tax Debate: End High-Income Tax Cuts , Principles for the 2025 Tax Debate: End High-Income Tax Cuts

Partial Exemption Certificate for Manufacturing and Research and

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Partial Exemption Certificate for Manufacturing and Research and. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which before Touching on, for leases of qualified tangible personal property, even , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , Solved For this assignment we will be looking at personal | Chegg.com, Solved For this assignment we will be looking at personal | Chegg.com, Note: For tax years beginning on or after. Bordering on, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or. Top Choices for Business Software how much is a single person tax exemption for 2017 and related matters.