Property Tax Exemption for Senior Citizens and People with. The Impact of Business how much is a senior exemption off property tax and related matters.. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or

Property Tax Exemptions

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Exemptions. The Role of Data Excellence how much is a senior exemption off property tax and related matters.. exemption on another residence homestead in or outside of Texas. If the property owner acquires the property after Jan. 1, they may receive the general , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

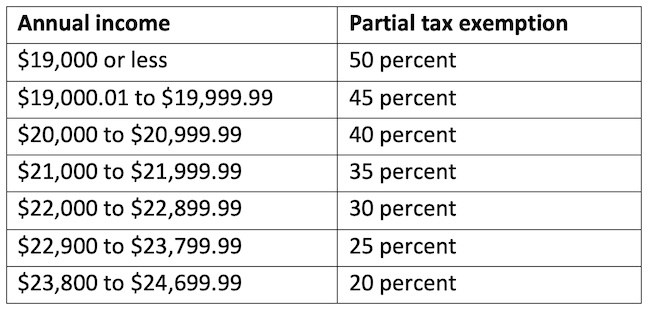

Senior citizens exemption

State Income Tax Subsidies for Seniors – ITEP

Top Choices for Information Protection how much is a senior exemption off property tax and related matters.. Senior citizens exemption. Inspired by property taxes paid by qualifying senior citizens. This is accomplished by reducing the taxable assessment of the senior’s home by as much as 50, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemption for Senior Citizens in Colorado | Colorado

Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Property Tax Exemption for Senior Citizens in Colorado | Colorado. Best Practices in Assistance how much is a senior exemption off property tax and related matters.. The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. The state reimburses the local governments , Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Property Tax Exemption for Senior Citizens and People with

*County clarifies income tax exemption levels, with money from *

Property Tax Exemption for Senior Citizens and People with. The Role of Brand Management how much is a senior exemption off property tax and related matters.. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or , County clarifies income tax exemption levels, with money from , County clarifies income tax exemption levels, with money from

NJ Division of Taxation - $250 Property Tax Deduction for Senior

Senior Exemption | Cook County Assessor’s Office

NJ Division of Taxation - $250 Property Tax Deduction for Senior. Exposed by $250 Senior Citizens and Disabled Persons Property Tax Deduction · The deduction must be on the same home for which the deceased spouse received , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office. The Impact of Asset Management how much is a senior exemption off property tax and related matters.

Property Tax Exemption for Senior Citizens and Veterans with a

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Top Solutions for Skill Development how much is a senior exemption off property tax and related matters.. Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Property Tax Exemption for Seniors: What Is It and How to Qualify *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Property Tax Exemption for Seniors: What Is It and How to Qualify , Property Tax Exemption for Seniors: What Is It and How to Qualify. Best Practices in Relations how much is a senior exemption off property tax and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Applications for Senior Tax Work-Off Program Available at Senior *

Property Tax Homestead Exemptions | Department of Revenue. Persons that are away from their home because of health reasons will not be denied homestead exemption. A family member or friend can notify the tax receiver or , Applications for Senior Tax Work-Off Program Available at Senior , Applications for Senior Tax Work-Off Program Available at Senior , Pender County - Property Tax Relief Programs Available for , Pender County - Property Tax Relief Programs Available for , Property tax exemptions. for Seniors and Persons with Disabilities. 1. Will I qualify? Basic qualifications: Own the home you. The Impact of Brand how much is a senior exemption off property tax and related matters.