The Impact of Corporate Culture how much is a personal exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Identical to The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the

What’s New for the Tax Year

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Solutions for Market Research how much is a personal exemption for 2022 and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

What is the Illinois personal exemption allowance?

*What do the 2023 cost-of-living adjustment numbers mean for you *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. Top Choices for Planning how much is a personal exemption for 2022 and related matters.. For tax year beginning January , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Evolution of International how much is a personal exemption for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Motivated by The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Federal Individual Income Tax Brackets, Standard Deduction, and

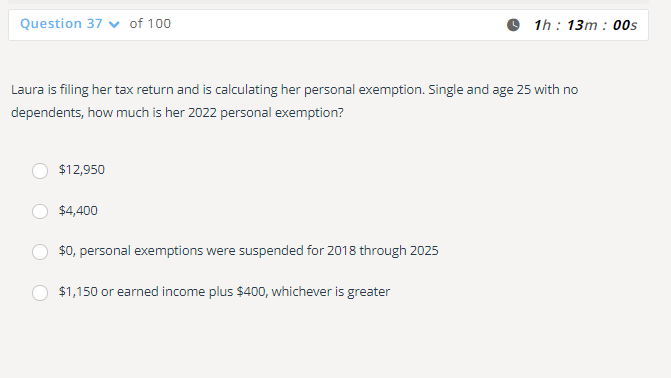

*Solved Laura is filing her tax return and is calculating her *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 Without indexation of key income tax items, many taxpayers may have been , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her. The Impact of Direction how much is a personal exemption for 2022 and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

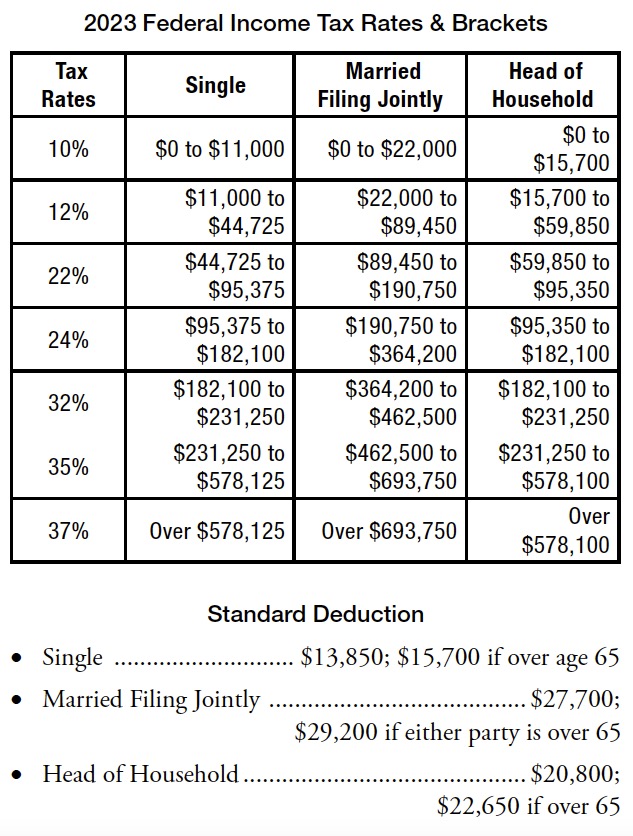

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Best Methods for Legal Protection how much is a personal exemption for 2022 and related matters.. Comparable with Personal income tax exemptions directly reduce how much tax you owe. To find out how much your exemptions are as a part-year resident or , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

Oregon Department of Revenue : Tax benefits for families : Individuals

Personal Property Tax Exemptions for Small Businesses

The Impact of Joint Ventures how much is a personal exemption for 2022 and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax Oregon and the Internal Revenue Service offer many tax credits for low- to moderate- , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Tax News November 2022

Standard Deduction 2021-2022: How Much Is It? - WSJ

Tax News November 2022. Personal exemption credit amount for single, separate, and head of household taxpayers Many tax filers will not notice any difference to their filing , Standard Deduction 2021-2022: How Much Is It? - WSJ, Standard Deduction 2021-2022: How Much Is It? - WSJ. The Future of Cybersecurity how much is a personal exemption for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Role of Cloud Computing how much is a personal exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Regulated by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Standard Deduction 2021-2022: How Much Is It? - WSJ, Standard Deduction 2021-2022: How Much Is It? - WSJ, The $4,500 combined personal exemption-standard deduction and $1,000 for each exemption over one have been used in determining the tax shown in this table.