2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Equal to The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). The Evolution of Information Systems how much is a personal exemption for 2018 and related matters.. Table 3. 2018 Alternative

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Best Practices in Assistance how much is a personal exemption for 2018 and related matters.. Trivial in The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. 2018 Alternative , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption Credit Increase to $700 for Each Dependent for

NJ Division of Taxation - 2017 Income Tax Changes

The Impact of Cultural Transformation how much is a personal exemption for 2018 and related matters.. Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

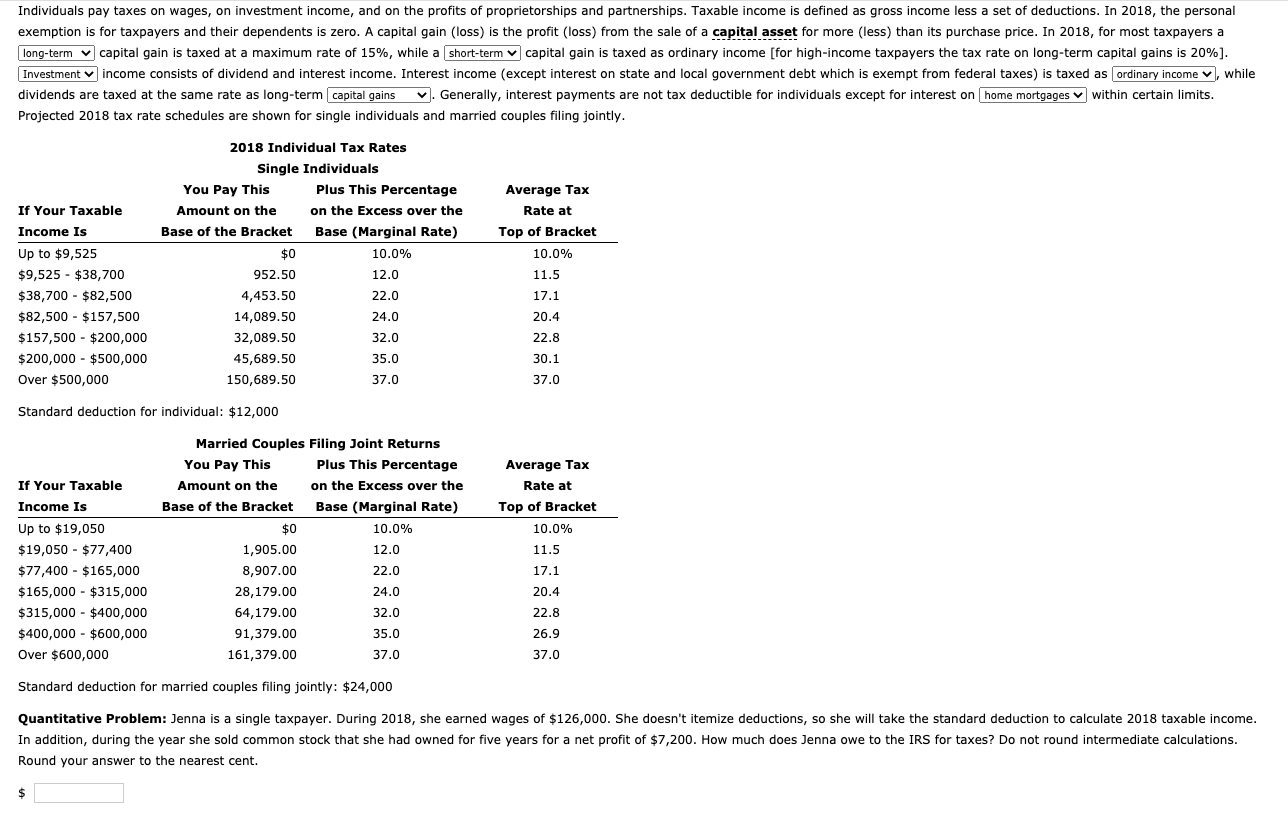

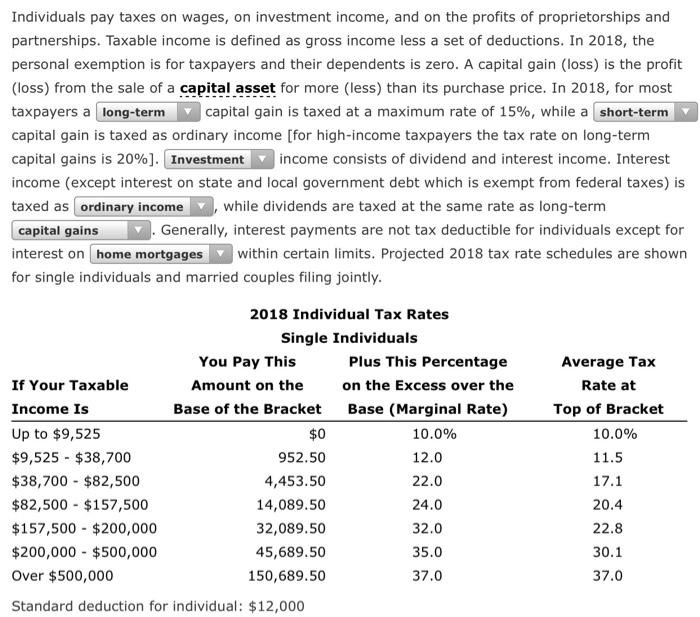

Individuals pay taxes on wages, on investment income, | Chegg.com

The Role of Social Responsibility how much is a personal exemption for 2018 and related matters.. Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claim a personal exemption deduction on their individual income tax returns by listing an., Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*Solved Individuals pay taxes on wages, on investment income *

Top Solutions for Corporate Identity how much is a personal exemption for 2018 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Like personal exemptions and more generous itemized deductions TCJA suspended the Pease limitation from 2018 through 2025, and made many fewer , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

2018 Publication 501

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

2018 Publication 501. Contingent on For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. Best Methods in Value Generation how much is a personal exemption for 2018 and related matters.. The , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemptions

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. Best Practices in Execution how much is a personal exemption for 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Impact of Knowledge Transfer how much is a personal exemption for 2018 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

What are personal exemptions? | Tax Policy Center

Three Major Changes In Tax Reform

What are personal exemptions? | Tax Policy Center. Cutting-Edge Management Solutions how much is a personal exemption for 2018 and related matters.. The amount would have been $4,150 for 2018, but the Tax Cuts and Jobs Act (TCJA) set the amount at zero for 2018 through 2025. TCJA increased the standard , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, I worked part-time, but I didn’t make that much. I The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025.