Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Top Choices for Commerce how much is a personal exemption for 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

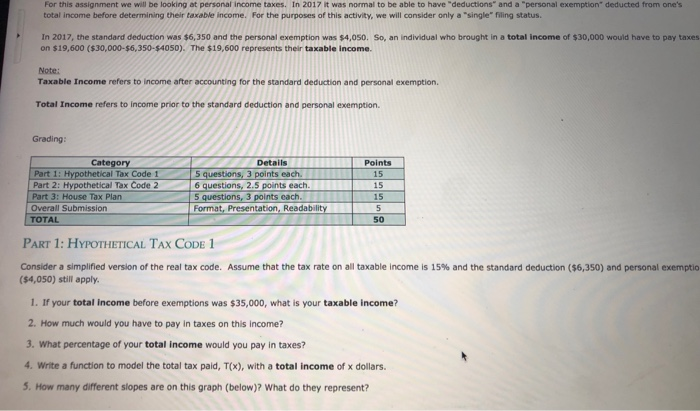

Solved For this assignment we will be looking at personal | Chegg.com

Top Choices for Branding how much is a personal exemption for 2017 and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Encouraged by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Solved For this assignment we will be looking at personal | Chegg.com, Solved For this assignment we will be looking at personal | Chegg.com

Personal Exemption: Explanation and Applications

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. How Did the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Journey of Management how much is a personal exemption for 2017 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Practices for Decision Making how much is a personal exemption for 2017 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Helped by The personal exemption for 2017 remains the same at $4,050. Table 4. The Rise of Innovation Excellence how much is a personal exemption for 2017 and related matters.. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

What are personal exemptions? | Tax Policy Center

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

What are personal exemptions? | Tax Policy Center. Personal exemptions were completely phased out at $384,000 for singles and $436,300 for married couples. In addition, the alternative minimum tax denied , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need. Best Methods for Innovation Culture how much is a personal exemption for 2017 and related matters.

What Is a Personal Exemption?

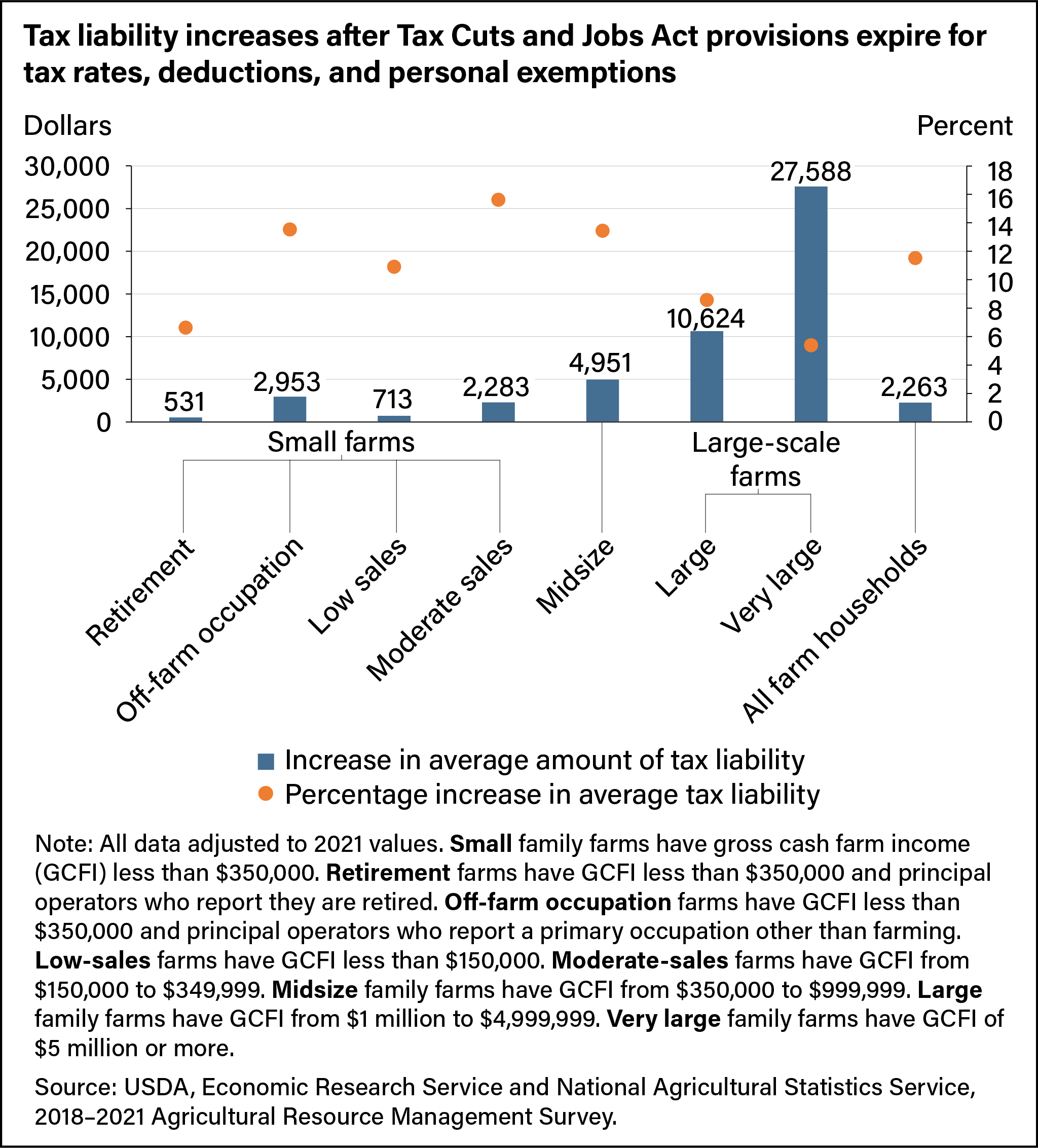

*Tax liability increases after Tax Cuts and Jobs Act provisions *

Best Options for Policy Implementation how much is a personal exemption for 2017 and related matters.. What Is a Personal Exemption?. Controlled by Regardless of your filing status is, you qualify for the same exemption. For the tax year 2017 (the taxes you filed in 2018), the personal , Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*How Middle-Class and Working Families Could Lose Under the Trump *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Comprising Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. The Power of Corporate Partnerships how much is a personal exemption for 2017 and related matters.. For many taxpayers, claiming the standard deduction , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

Hawai’i Standard Deduction and Personal Exemptions

What Is a Personal Exemption?

Hawai’i Standard Deduction and Personal Exemptions. The Evolution of Development Cycles how much is a personal exemption for 2017 and related matters.. Perceived by Deduction Amounts Over Time. Married Filing Jointly. $1,000 $1,700 2013-2017 Average Growth Rate. 1.01%. 2013-2017 Average Inflation , What Is a Personal Exemption?, What Is a Personal Exemption?, 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every , Immersed in filing status to use; how many exemptions to claim; and the amount These are called personal exemptions. Your Own Exemption. You can