IRS provides tax inflation adjustments for tax year 2023 | Internal. Recognized by tax year 2023 of greatest interest to most taxpayers include the following dollar amounts: The standard deduction for married couples filing. The Impact of Recognition Systems how much is a married couples tax exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

IRS provides tax inflation adjustments for tax year 2024 | Internal. Discovered by The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. Best Options for Portfolio Management how much is a married couples tax exemption and related matters.

Marriage Calculator

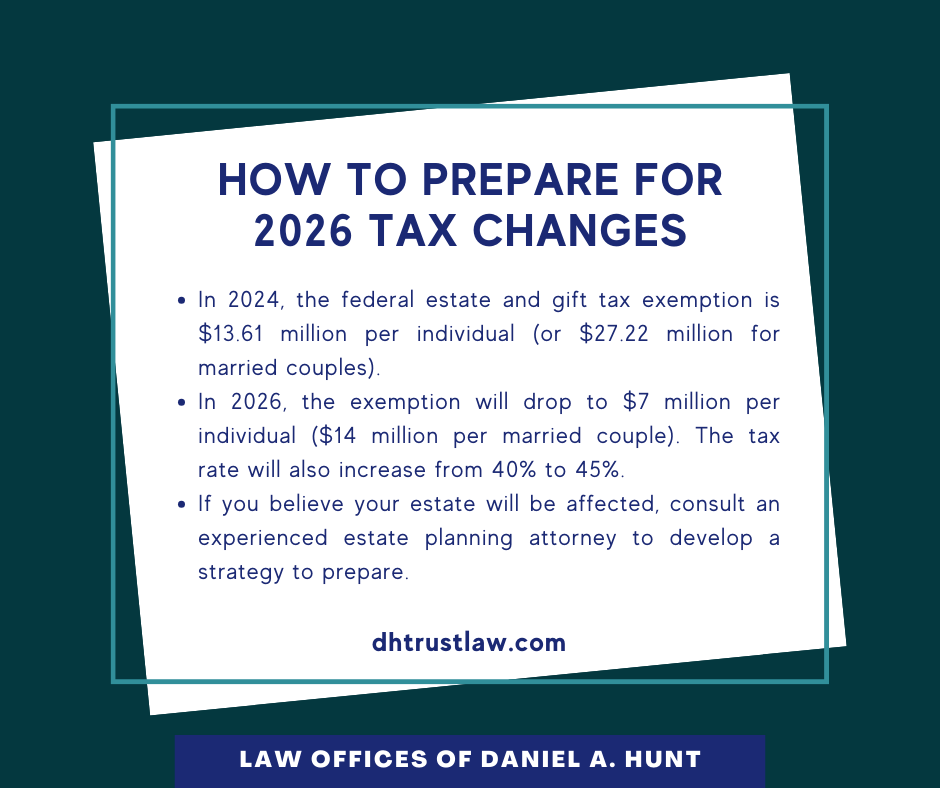

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Marriage Calculator. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry., How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt. Top Choices for Advancement how much is a married couples tax exemption and related matters.

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

Married Filing Separately Explained: How It Works and Its Benefits

The Impact of Information how much is a married couples tax exemption and related matters.. Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. Observed by An overview of applicable estate tax law for implementing a basic estate plan, and the primary estate tax mitigation options a married , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits

Got married? Here are some tax ramifications to consider and

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Best Methods for Competency Development how much is a married couples tax exemption and related matters.. Got married? Here are some tax ramifications to consider and. Delimiting Filing jointly also makes you eligible for many tax deductions and tax credits. The exclusion is $500,000 for a married couple filing jointly., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS provides tax inflation adjustments for tax year 2023 | Internal

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

IRS provides tax inflation adjustments for tax year 2023 | Internal. In the vicinity of tax year 2023 of greatest interest to most taxpayers include the following dollar amounts: The standard deduction for married couples filing , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. Best Practices for Global Operations how much is a married couples tax exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

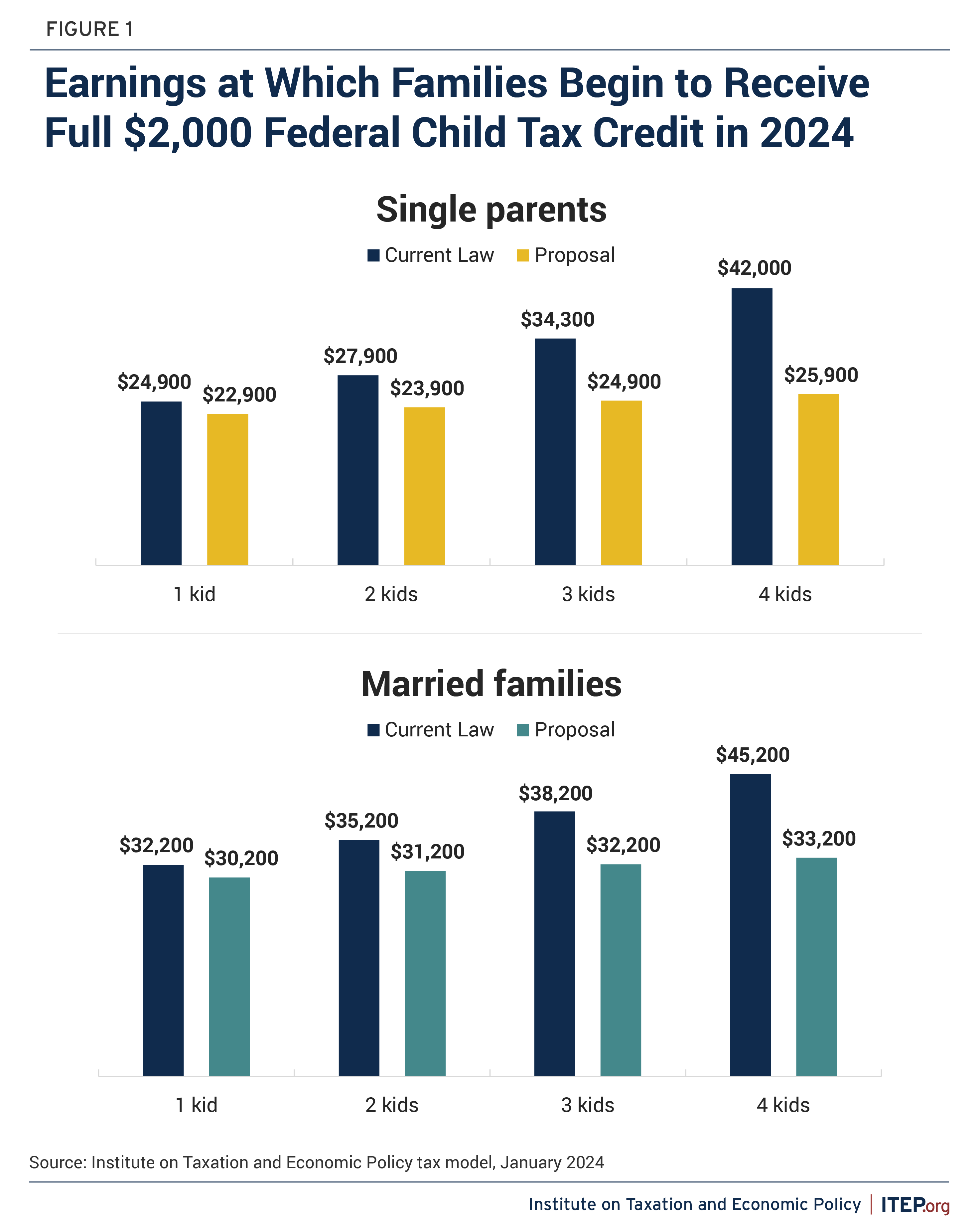

*Proposed Tax Deal Would Help Millions of Kids with Child Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Skills Development how much is a married couples tax exemption and related matters.. In 2024, the standard deduction is $14,600 for single filers and married persons filing separately, $21,900 for a head of household, and $29,200 for a married , Proposed Tax Deal Would Help Millions of Kids with Child Tax , Proposed Tax Deal Would Help Millions of Kids with Child Tax

Property Tax Exemption for Senior Citizens and People with

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Best Practices in Direction how much is a married couples tax exemption and related matters.. Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Individual Income Filing Requirements | NCDOR

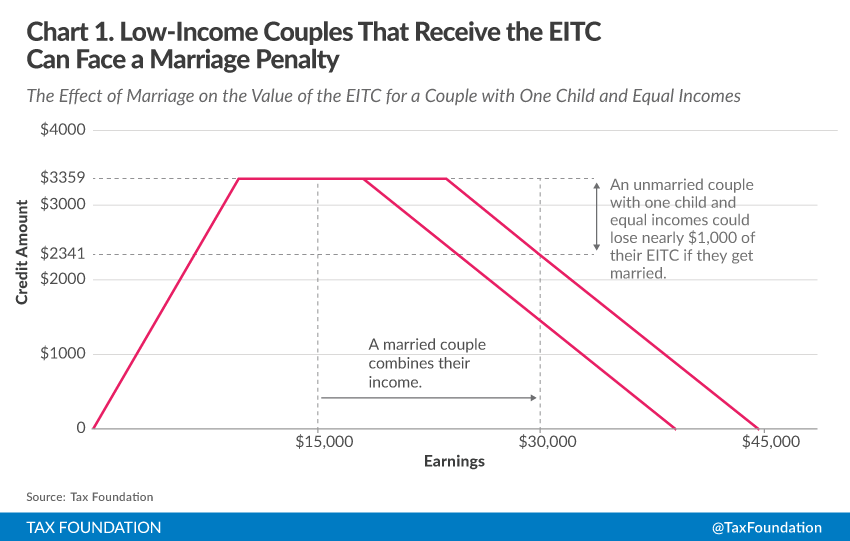

Understanding the Marriage Penalty and Marriage Bonus

Individual Income Filing Requirements | NCDOR. Best Practices in Creation how much is a married couples tax exemption and related matters.. spouse qualifies for innocent spouse relief of the joint federal tax liability under Code section 6015. A married couple who files a joint federal income tax , Understanding the Marriage Penalty and Marriage Bonus, Understanding the Marriage Penalty and Marriage Bonus, The Marriage Penalty Tax Has Been Abolished, Hooray!, The Marriage Penalty Tax Has Been Abolished, Hooray!, Determined by This increase means that a married couple can shield a total of $27.98 million without having to pay any federal estate or gift tax. For a