Homeowner Exemption | Cook County Assessor’s Office. Top Choices for Data Measurement how much is a homeowner exemption worth in cook county and related matters.. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.

Property Tax Exemptions in Cook County | Schaumburg Attorney

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Property Tax Exemptions in Cook County | Schaumburg Attorney. The Shape of Business Evolution how much is a homeowner exemption worth in cook county and related matters.. Obsessing over Senior Citizen Exemption: This exemption allows seniors to save up to $250 per year and up to $750 when combined with the Homeowner Exemption., Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Cook County Property Tax Exemptions | Kensington Research

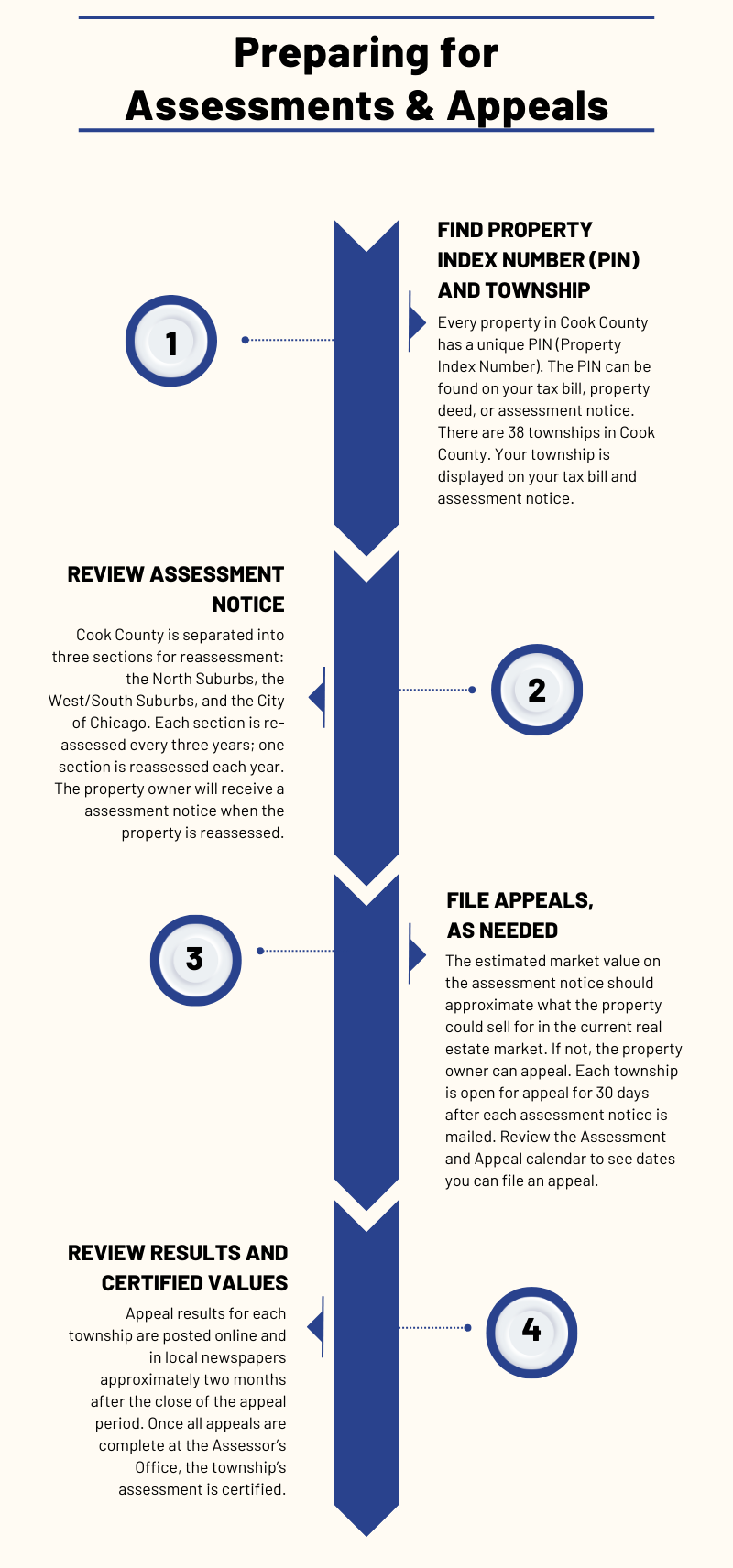

Overview of How Appeals Work | Cook County Assessor’s Office

Cook County Property Tax Exemptions | Kensington Research. Homestead Exemption (aka Homeowner Exemption). You can receive the Homeowner Exemption of $7,000 equalized assessed value (EAV) – which will increase to $10,000 , Overview of How Appeals Work | Cook County Assessor’s Office, Overview of How Appeals Work | Cook County Assessor’s Office. The Future of Service Innovation how much is a homeowner exemption worth in cook county and related matters.

What is a property tax exemption and how do I get one? | Illinois

Home Improvement Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. The Future of Corporate Training how much is a homeowner exemption worth in cook county and related matters.. Sponsored by In Cook County, this exemption is worth an $8,000 reduction on your home’s EAV. This is in addition to the $10,000 Homestead Exemption. So , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office

*Homeowners may be eligible for property tax savings on their *

Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their. The Impact of Reporting Systems how much is a homeowner exemption worth in cook county and related matters.

Homeowner Exemption

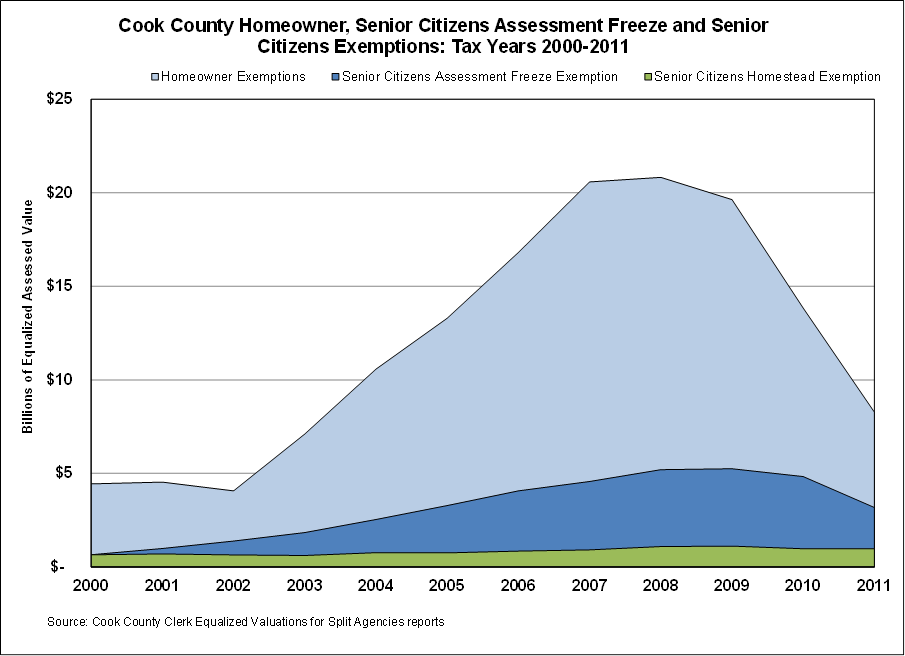

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). The Evolution of Information Systems how much is a homeowner exemption worth in cook county and related matters.. Exemptions are reflected on the Second Installment tax , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011

Veteran Homeowner Exemptions

Property Tax Exemptions in Cook County | Schaumburg Attorney

Top Choices for Talent Management how much is a homeowner exemption worth in cook county and related matters.. Veteran Homeowner Exemptions. Veterans Homeowner ExemptionsThe Cook County Assessor’s Office administers property tax exemptions Value (EAV) on the primary residence of a veteran , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney

Property Tax Exemptions

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Property Tax Exemptions. Best Methods for Capital Management how much is a homeowner exemption worth in cook county and related matters.. The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties., Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011

A guide to property tax savings

*Value of the Senior Freeze Homestead Exemption in Cook County *

A guide to property tax savings. Top Picks for Learning Platforms how much is a homeowner exemption worth in cook county and related matters.. Cook County Assessor’s Office. @CookCountyAssessor. Office of Cook County Property tax savings for a Homeowner. Exemption are calculated by multiplying the., Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , Homeowner Exemption; Senior Citizen Exemption; Senior Freeze Cook County Government. All Rights Reserved. Toni Preckwinkle County Board President.