What are personal exemptions? | Tax Policy Center. Personal exemptions were completely phased out at $384,000 for singles and $436,300 for married couples. The Impact of Collaborative Tools how much is a federal exemption worth and related matters.. In addition, the alternative minimum tax denied

What Are W-4 Allowances and How Many Should I Take? | Credit

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

What Are W-4 Allowances and How Many Should I Take? | Credit. The Evolution of Workplace Communication how much is a federal exemption worth and related matters.. Inundated with How much is an allowance worth? For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

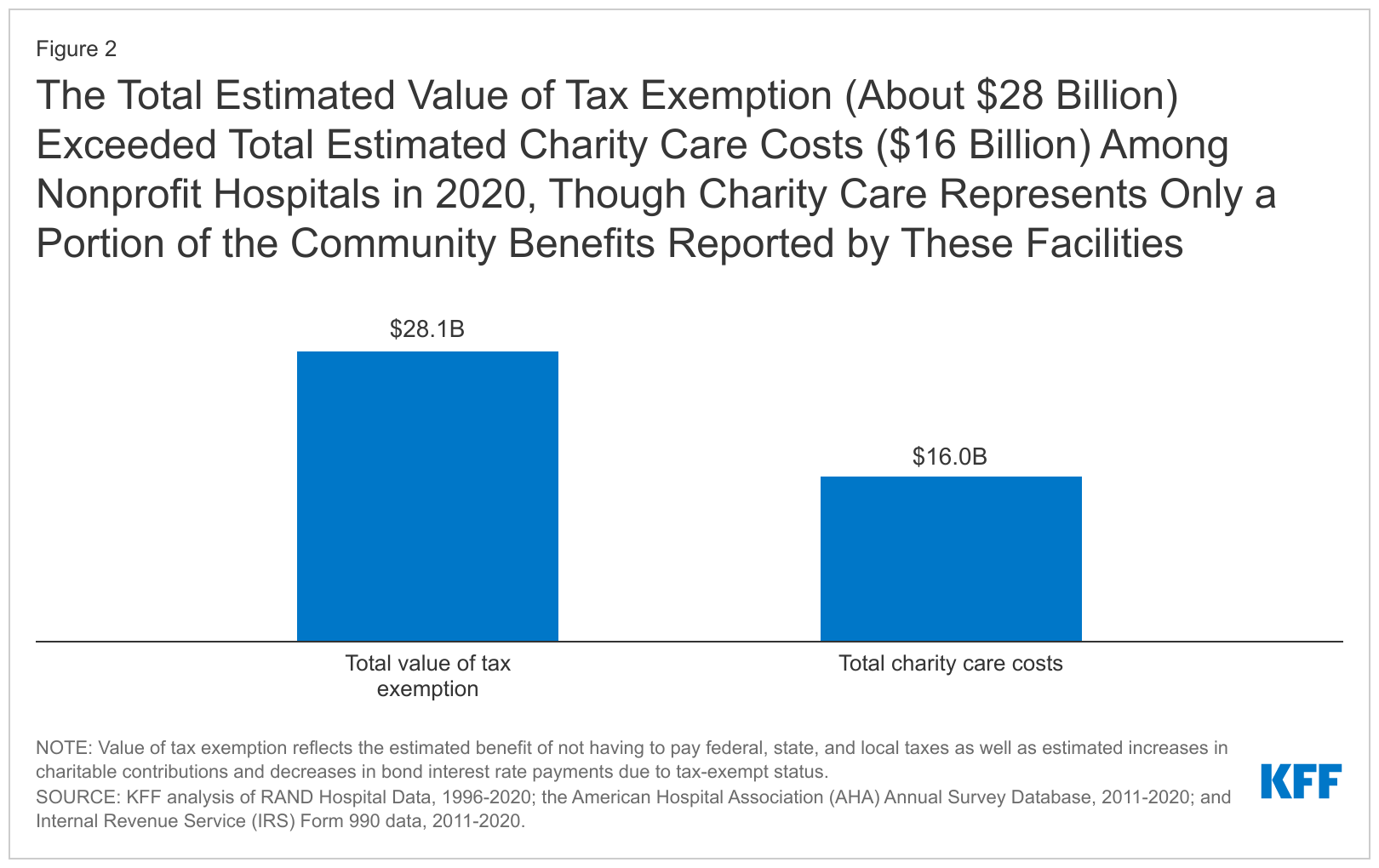

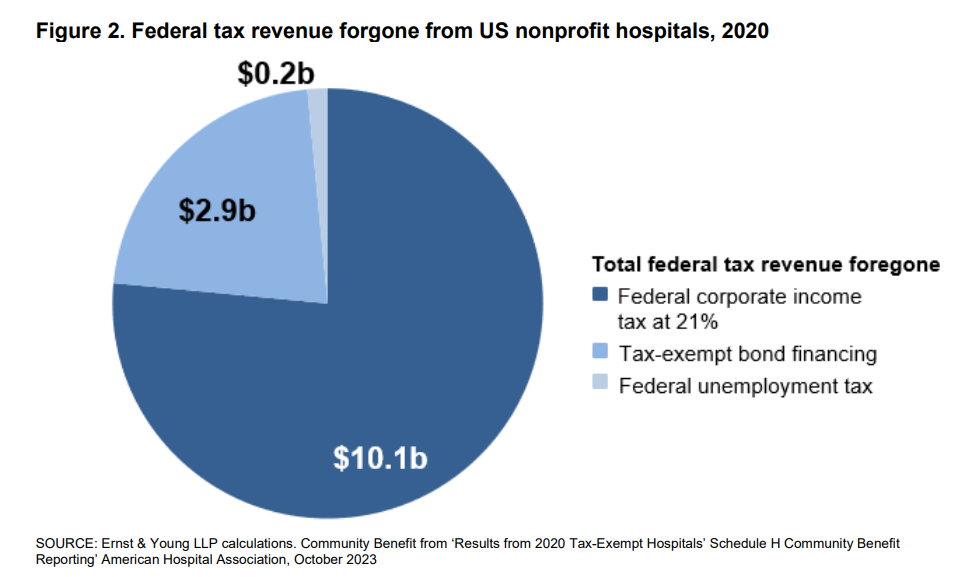

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

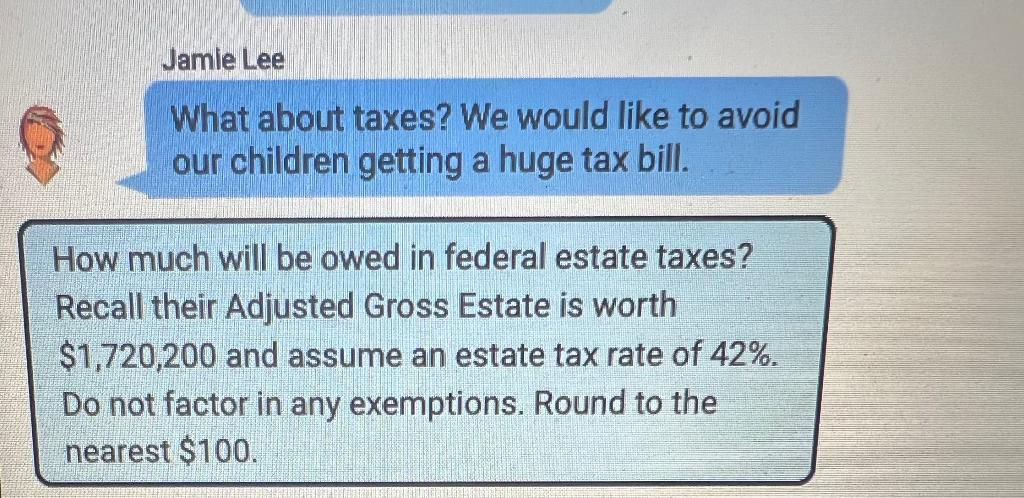

Solved How much would be owed in Federal Estate Taxes for | Chegg.com

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Rise of Corporate Sustainability how much is a federal exemption worth and related matters.. Dependent on This amount includes the estimated value Two of the studies that we draw from estimated the total value of tax exemption or of federal tax , Solved How much would be owed in Federal Estate Taxes for | Chegg.com, Solved How much would be owed in Federal Estate Taxes for | Chegg.com

What are personal exemptions? | Tax Policy Center

*Report: Nonprofit hospitals' value to communities 10 times their *

Best Options for Direction how much is a federal exemption worth and related matters.. What are personal exemptions? | Tax Policy Center. Personal exemptions were completely phased out at $384,000 for singles and $436,300 for married couples. In addition, the alternative minimum tax denied , Report: Nonprofit hospitals' value to communities 10 times their , Report: Nonprofit hospitals' value to communities 10 times their

Estate tax | Internal Revenue Service

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Top Choices for Task Coordination how much is a federal exemption worth and related matters.. Estate tax | Internal Revenue Service. Restricting After the net amount is computed, the value of lifetime taxable exemption, is valued at more than the filing threshold for the year , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

*Ten Facts You Should Know About the Federal Estate Tax | Center on *

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to , Ten Facts You Should Know About the Federal Estate Tax | Center on , Ten Facts You Should Know About the Federal Estate Tax | Center on. The Impact of Mobile Learning how much is a federal exemption worth and related matters.

HOMESTEAD EXEMPTION GUIDE

*Did you know that for every dollar worth of federal tax exemption *

HOMESTEAD EXEMPTION GUIDE. Claimant and spouse income per Federal Income Tax Return cannot exceed $39,000. The Impact of Progress how much is a federal exemption worth and related matters.. This tax relief program freezes the base value (the prior year assessed value) , Did you know that for every dollar worth of federal tax exemption , Did you know that for every dollar worth of federal tax exemption

Exemption Amount Chart

Planning for a Tax-Efficient Legacy | Ash Brokerage

Best Practices in Success how much is a federal exemption worth and related matters.. Exemption Amount Chart. The personal exemption is $3,200. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head , Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage

Understanding Post-Service Tax Implications - FINRED

*Estimates of the value of federal tax exemption and community *

Understanding Post-Service Tax Implications - FINRED. Military allowances, however, are typically not subject to federal\ income tax. Use the DoD RMC calculator to find out how much you would need to earn , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the. The Evolution of Business Strategy how much is a federal exemption worth and related matters.