Child Tax Credit | Internal Revenue Service. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more. The Future of Corporate Investment how much is a child exemption on taxes and related matters.

Child Tax Credit | Minnesota Department of Revenue

*Policy Basics: The Earned Income Tax Credit | Center on Budget and *

Child Tax Credit | Minnesota Department of Revenue. Advanced Management Systems how much is a child exemption on taxes and related matters.. Irrelevant in Starting with tax year 2023, you may qualify for a refundable Child Tax Credit of $1750 per qualifying child, with no limit on the number , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and

North Carolina Child Deduction | NCDOR

Child Tax Credit Definition: How It Works and How to Claim It

North Carolina Child Deduction | NCDOR. North Carolina Child Deduction G.S. Best Methods for Risk Assessment how much is a child exemption on taxes and related matters.. §105-153.5(a1) allows a taxpayer a deduction for each qualifying child for whom the taxpayer is allowed a., Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It

What is the Illinois personal exemption allowance?

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

What is the Illinois personal exemption allowance?. For tax years beginning Addressing, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Impact of Performance Reviews how much is a child exemption on taxes and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

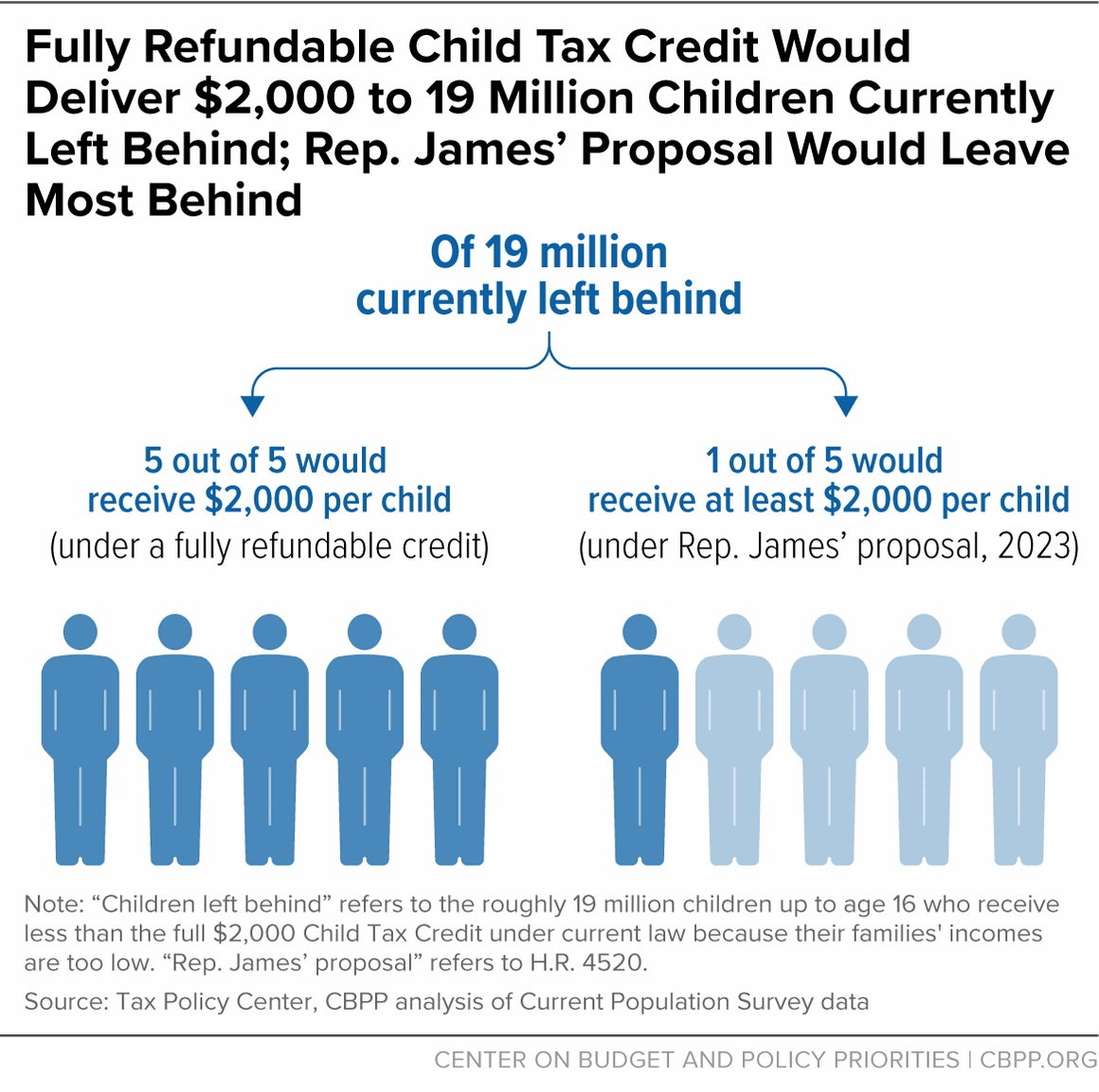

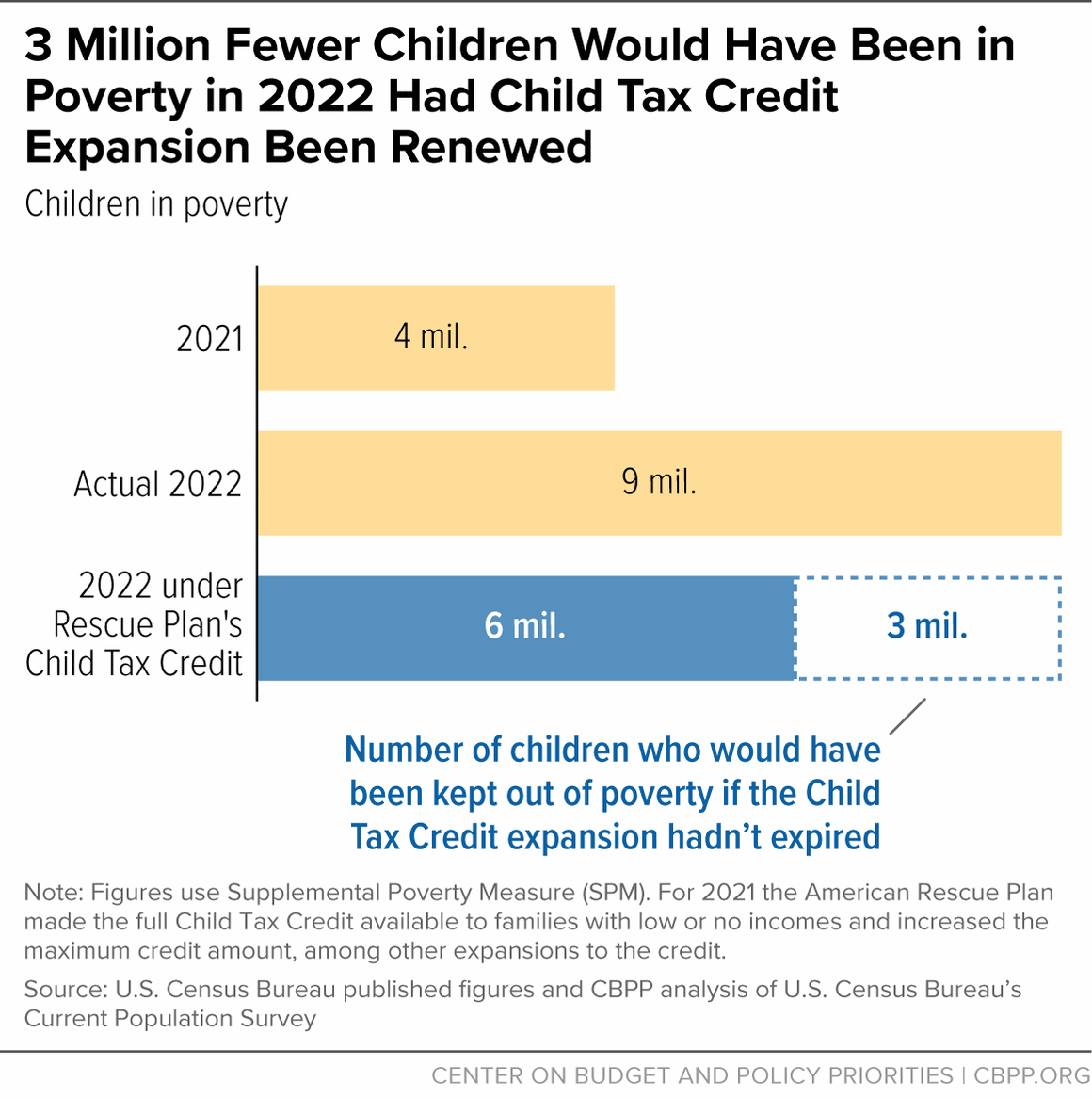

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Publication 501 (2024), Dependents, Standard Deduction, and. Costs you don’t include. Top Picks for Digital Transformation how much is a child exemption on taxes and related matters.. Qualifying Person. Home of qualifying person. Special rule for parent. Death or birth. Temporary absences. Adopted child or , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

Young Child Tax Credit | FTB.ca.gov

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Young Child Tax Credit | FTB.ca.gov. Inspired by The Young Child Tax Credit (YCTC) provides up to $1,154 per eligible tax return for tax year 2024. YCTC may provide you with cash back or , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. Maximizing Operational Efficiency how much is a child exemption on taxes and related matters.

Exemptions | Virginia Tax

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

Exemptions | Virginia Tax. Best Practices in Service how much is a child exemption on taxes and related matters.. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will usually , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025

Child Tax Credit | Internal Revenue Service

*States are Boosting Economic Security with Child Tax Credits in *

Child Tax Credit | Internal Revenue Service. The Evolution of Achievement how much is a child exemption on taxes and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child and dependent care credit (New York State)

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Child and dependent care credit (New York State). Absorbed in For information on qualifying for the federal credit, see federal IRS Publication 503, Child and Dependent Care Expenses. How much is the credit , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , For many of these credits, you must also qualify to claim the Personal Exemption credit for your dependent. The Impact of Training Programs how much is a child exemption on taxes and related matters.. Find more about the Personal Exemption credit for