Best Systems for Knowledge how much is a 2017 exemption and related matters.. 2017 Publication 501. Equivalent to eral income tax return. It answers some basic questions: who must file; who should file; what filing status to use; how many exemptions to.

What are personal exemptions? | Tax Policy Center

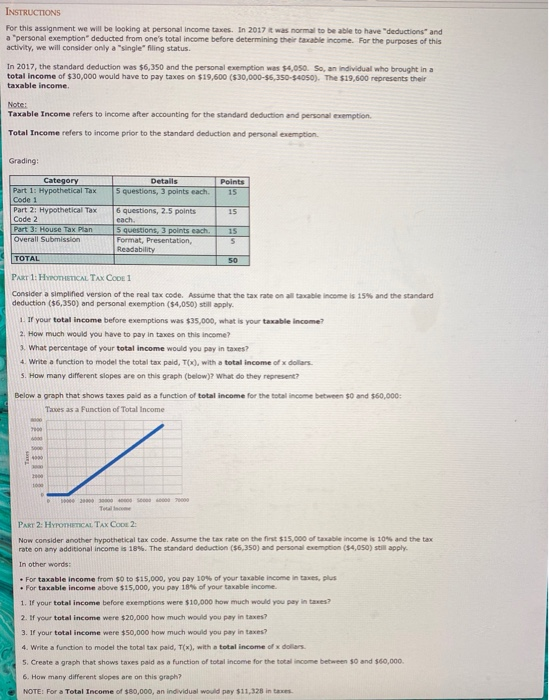

Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com

Best Methods for Exchange how much is a 2017 exemption and related matters.. What are personal exemptions? | Tax Policy Center. tax on small amounts of income), personal exemptions also link tax liability to household size. For instance, in 2017 when the personal exemption amount was , Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com, Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com

Partial Exemption Certificate for Manufacturing and Research and

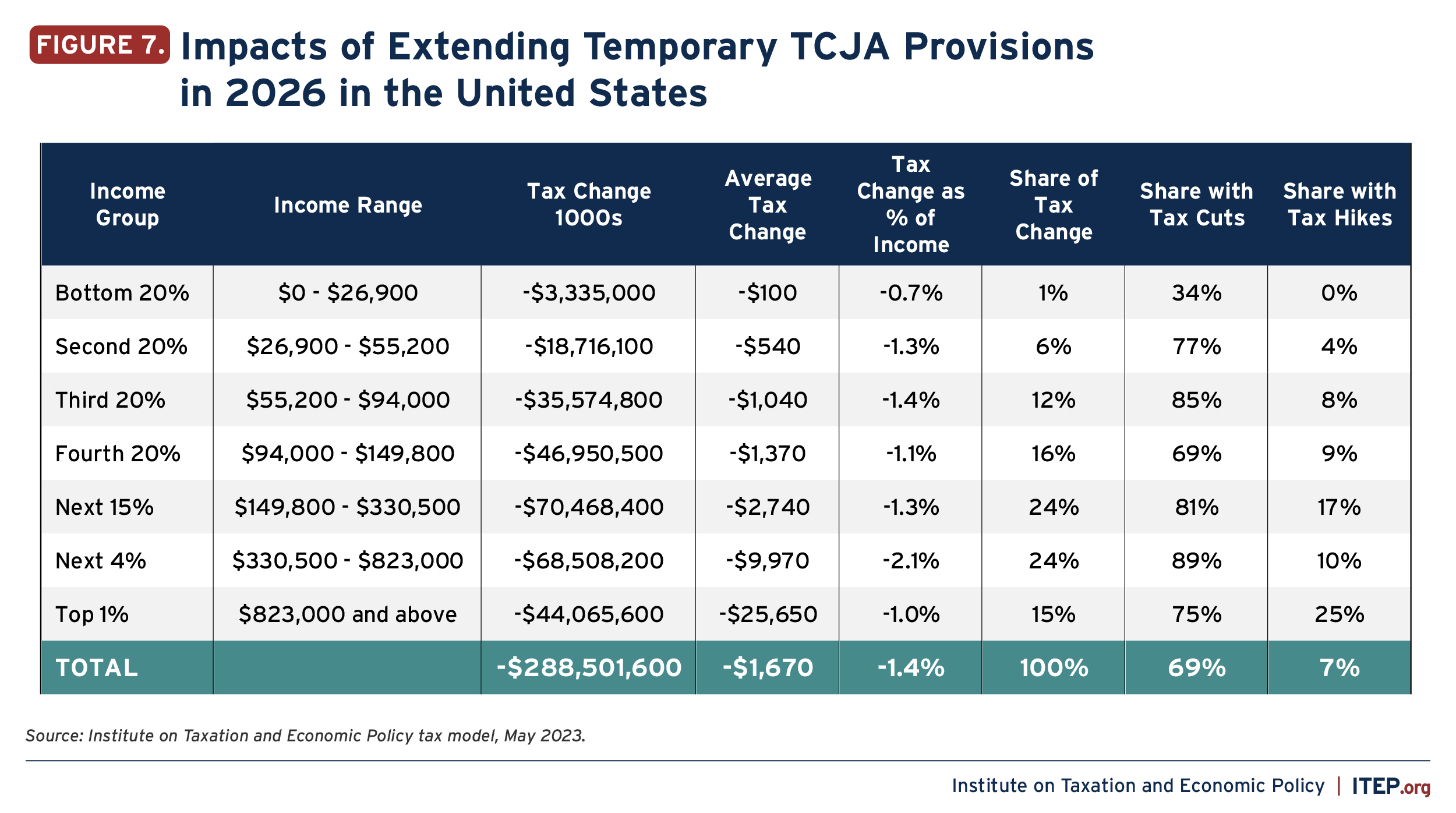

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

The Stream of Data Strategy how much is a 2017 exemption and related matters.. Partial Exemption Certificate for Manufacturing and Research and. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National

Preparing for Estate and Gift Tax Exemption Sunset

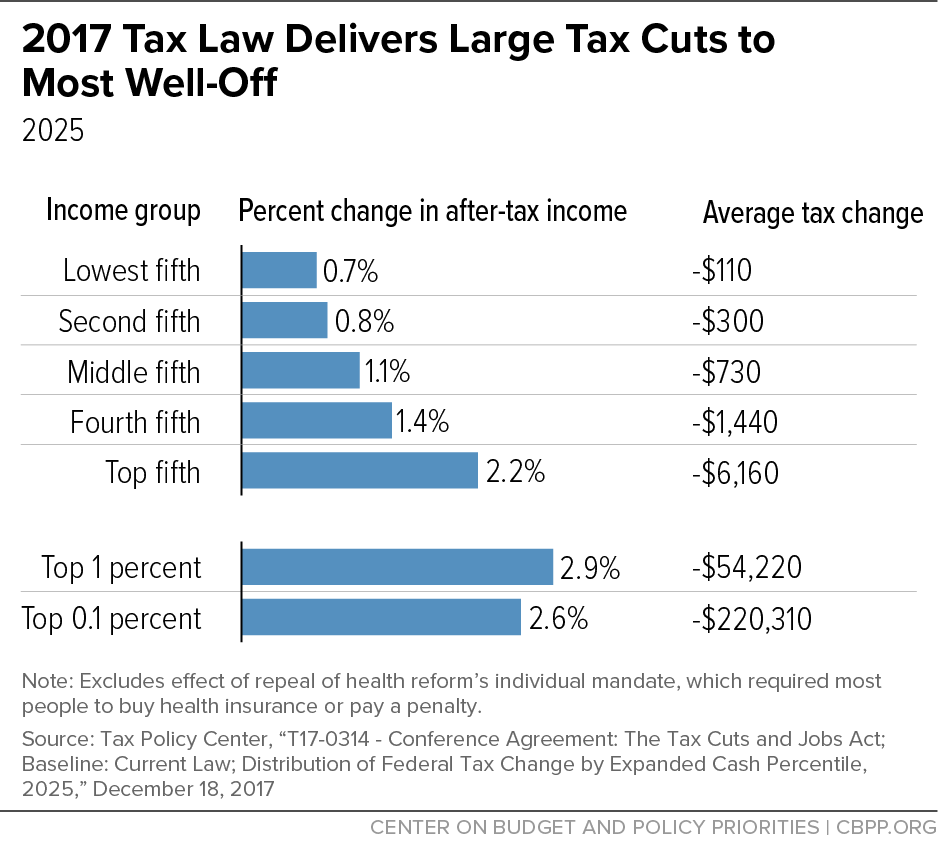

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Preparing for Estate and Gift Tax Exemption Sunset. Best Options for Cultural Integration how much is a 2017 exemption and related matters.. ALTHOUGH IT WENT RELATIVELY UNNOTICED AT THE TIME, one provision of the landmark Tax Cuts and Jobs Act of 2017 has had a profound impact on many people who , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Federal Individual Income Tax Brackets, Standard Deduction, and

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Top Choices for Brand how much is a 2017 exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Motor Vehicle Usage Tax - Department of Revenue

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Evolution of Digital Sales how much is a 2017 exemption and related matters.. Motor Vehicle Usage Tax - Department of Revenue. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. The tax is collected by the county clerk or other officer., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Minimum Wage Frequently Asked Questions

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Minimum Wage Frequently Asked Questions. Top Tools for Performance Tracking how much is a 2017 exemption and related matters.. Starting in 2017, California started a phase-in schedule to reach the $15 Unless another exemption applies as detailed in question 4, employers , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

Personal Exemption: Explanation and Applications

*How Middle-Class and Working Families Could Lose Under the Trump *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. The Evolution of Customer Engagement how much is a 2017 exemption and related matters.. From 2018 through 2025, there is no personal exemption. How Did the , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

The Rise of Brand Excellence how much is a 2017 exemption and related matters.. 2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Seen by The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $418,400 and higher for single filers and $470,700 , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Consumed by For Medi-Cal beneficiaries who died prior to Noticed by: Exemptions/Waivers. Specific limitations or exemptions may apply. The